Rising Interest Rates and Real Estate: Understanding Market Dynamics

Rising Interest Rates and Real Estate: Understanding Market Dynamics

As rising interest rates create uncertainty in the real estate market, it's crucial to understand the underlying dynamics at play. This blog will explore how supply and demand, rather than interest rates alone, are shaping the future of real estate prices.

💔 The Myth of Interest Rates and Real Estate Prices

Many believe that rising interest rates lead directly to falling real estate prices. This notion oversimplifies a complex issue. While it's true that higher interest rates can reduce the number of buyers able to afford homes, this is only part of the story.

Demand for housing does indeed decrease when borrowing costs rise. However, the supply side often plays a more significant role in determining prices. With historically low inventory levels, even a slight dip in demand may not lead to substantial price drops.

In many markets, the competition remains fierce, and desirable properties still attract multiple offers. Therefore, while interest rates are a factor, they are not the sole driver of real estate prices.

📈 Understanding Demand in Real Estate

Demand in real estate is influenced by various factors, including economic conditions, employment rates, and consumer confidence. When interest rates rise, potential buyers may hesitate. Yet, this hesitance doesn't always translate to a dramatic decrease in demand.

In some cases, buyers may rush to purchase before rates increase further, creating a temporary spike in demand. Understanding these market dynamics is crucial for anyone looking to buy or sell property.

Ultimately, demand is shaped by how buyers perceive the market. A thriving job market and robust economy can sustain demand, even in the face of rising interest rates.

🏠 The Impact of Supply on the Market

Supply is a critical element in the real estate equation. When supply is low, prices can remain stable or even increase, despite rising interest rates. Recent years have seen a significant decrease in available homes, leading to tight inventory levels.

With fewer homes on the market, competition among buyers can still drive prices up. This scenario highlights the importance of supply in the real estate market. Even as interest rates rise, the lack of supply can mitigate potential price declines.

Understanding the balance between supply and demand is essential for making informed decisions in real estate. A market with low supply can still thrive, even amidst rising interest rates.

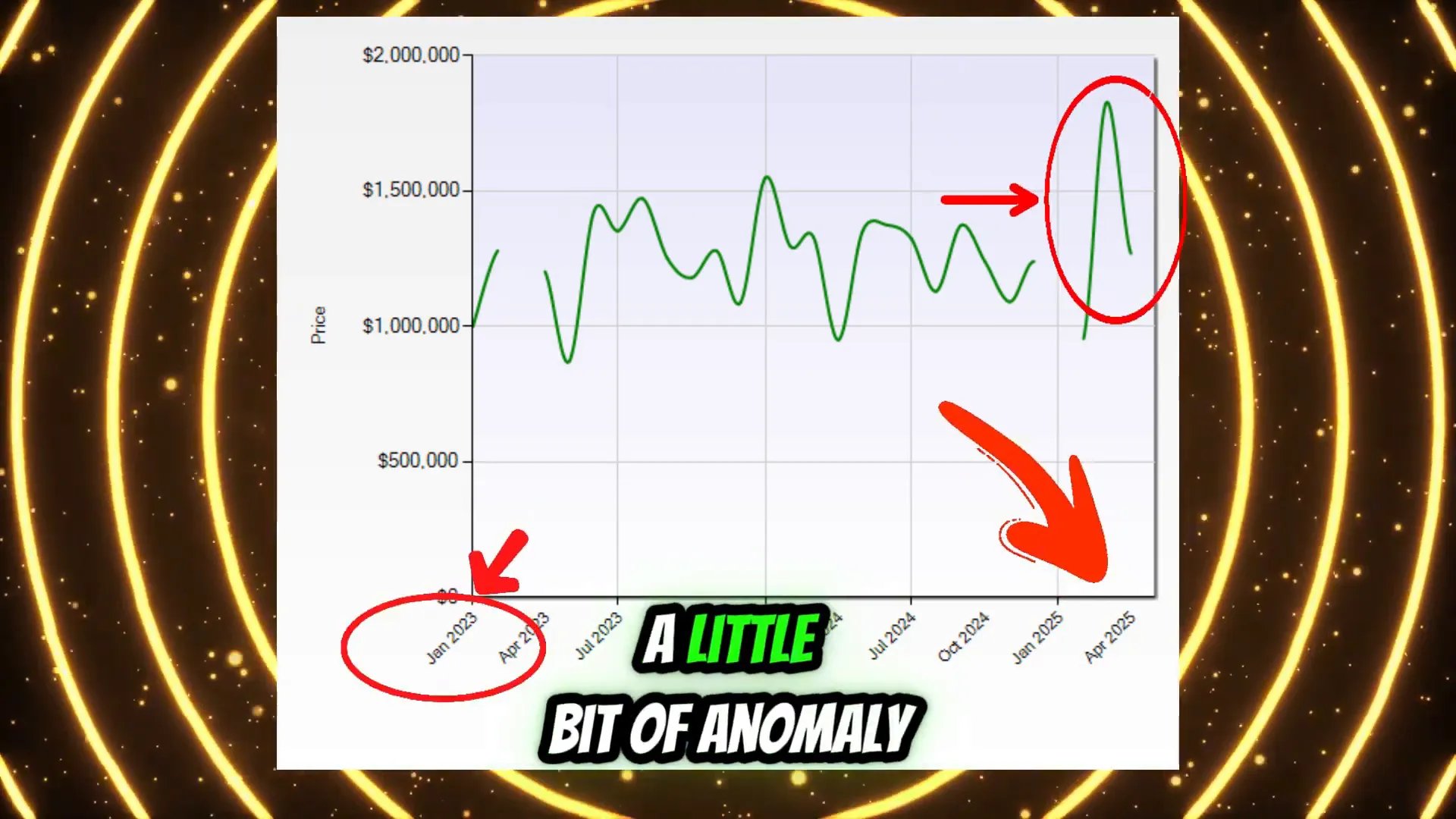

📊 Current Inventory Levels Explained

Current inventory levels are crucial for understanding today's real estate landscape. We are witnessing some of the lowest inventory levels on record. This situation has persisted since the pandemic, creating a competitive environment for buyers.

- Low Inventory: The market is experiencing a significant shortage of homes, affecting price stability.

- Buyer Competition: Multiple offers on desirable properties are common, leading to bidding wars.

- Market Trends: Observing local market trends can provide insights into how inventory levels impact prices.

Even with rising interest rates, the tight inventory means that prices may not fall as significantly as some predict. Buyers need to be aware of these dynamics to navigate the market effectively.

📉 What Happens When Interest Rates Rise?

When interest rates rise, the immediate effect is often a decline in the number of buyers who can afford homes. This decrease can lead to a slowdown in market activity. However, the overall impact on prices is more nuanced.

As mentioned earlier, if supply remains constrained, prices may hold steady or only drop slightly. The key takeaway is that rising interest rates do not automatically result in plummeting home prices.

In fact, many markets may see a reduction in the number of offers on properties, but this doesn't necessarily equate to a dramatic decrease in prices. Understanding these trends can help buyers and sellers make strategic decisions in their real estate ventures.

📊 Market Competition and Offer Dynamics

In today's real estate market, competition among buyers remains intense, despite the increasing interest rates. The dynamics of offers can shift quickly, influenced by both demand and supply factors.

When interest rates rise, the number of buyers who can afford a home typically declines. However, the existing low inventory levels mean that desirable properties still attract multiple offers. In some markets, buyers are competing for homes, leading to bidding wars.

As a result, while the overall number of offers may decrease, the competition for well-priced homes remains fierce. This scenario exemplifies how market competition can persist even in a challenging financial environment.

🔍 Understanding Offer Dynamics

Offer dynamics are influenced by several factors, including location, property type, and market conditions. In a low-inventory market, properties can receive numerous offers, driving prices up despite rising interest rates.

- Desirable Locations: Homes in sought-after areas often attract higher levels of competition.

- Property Condition: Well-maintained properties tend to generate more interest.

- Market Timing: Buyers may rush to purchase before rates rise further, increasing competition.

Understanding these factors can help buyers and sellers navigate the complexities of the market and make informed decisions.

📉 Potential Price Adjustments in Real Estate

As interest rates rise, potential price adjustments in real estate become a topic of interest. While many anticipate a decline in prices, the reality is often more complex.

In markets with low inventory, prices may not drop significantly. Even if demand decreases, the limited supply can keep prices relatively stable. However, some areas may experience slight price adjustments as competition lessens.

It's essential to analyze local market conditions to understand how prices may react to rising interest rates. Buyers and sellers should keep a close eye on trends to make strategic decisions.

💰 Factors Influencing Price Adjustments

Several key factors influence potential price adjustments in the real estate market:

- Supply Levels: Low inventory can sustain prices despite decreased demand.

- Buyer Sentiment: Confidence in the market can drive demand, even in higher rate environments.

- Economic Conditions: A robust economy can support real estate prices, offsetting interest rate impacts.

By considering these factors, stakeholders can better predict how the market will react and adjust their strategies accordingly.

🔮 Long-Term Outlook for Real Estate Investment

The long-term outlook for real estate investment remains positive, even amid rising interest rates. Historically, real estate has proven to be a resilient investment, offering stability over time.

Investors should focus on the fundamentals: location, property type, and market trends. While short-term fluctuations may occur, the long-term value of real estate tends to appreciate.

Moreover, with the current low inventory, real estate remains an attractive investment option. As demand continues to outpace supply, investors can expect steady growth in property values.

📈 Strategies for Long-Term Investment

For those considering real estate investment, implementing effective strategies is crucial:

- Focus on Growth Areas: Identify neighborhoods with high potential for appreciation.

- Consider Rental Properties: Rental demand remains strong, providing consistent cash flow.

- Diversify Investments: Explore different property types to mitigate risk.

By applying these strategies, investors can navigate rising interest rates and continue to build wealth through real estate.

🤔 Navigating Your Real Estate Questions

As the real estate landscape continues to evolve, questions from buyers and sellers grow. Understanding the current market dynamics is essential for making informed decisions.

If you have specific questions regarding rising interest rates and real estate, don’t hesitate to reach out. Whether it's about local market conditions or investment strategies, getting expert advice can clarify uncertainties.

Engaging with professionals can provide valuable insights tailored to your unique situation. Remember, staying informed is key in a fluctuating market.

❓ FAQ: Common Questions About Rising Interest Rates

As rising interest rates impact the real estate market, many common questions arise. Here are some frequently asked questions to clarify concerns:

- Will rising interest rates cause home prices to drop?

Not necessarily. While demand may decrease, low inventory can keep prices stable or even push them up in competitive markets.

- How can I navigate buying a home during rising rates?

Focus on securing financing early and consider homes that are priced competitively to increase your chances of success.

- Is it a good time to invest in real estate?

Yes, long-term investment remains favorable, especially in areas with strong demand and low inventory.

By addressing these questions, buyers and sellers can better prepare themselves for the challenges and opportunities presented by rising interest rates.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION