Up, Up, and Away: How Rising Interest Rates Affect Your Home Buying Decision

Understanding the Impact of Rising Interest Rates on Home Buying

Definition of Interest Rates

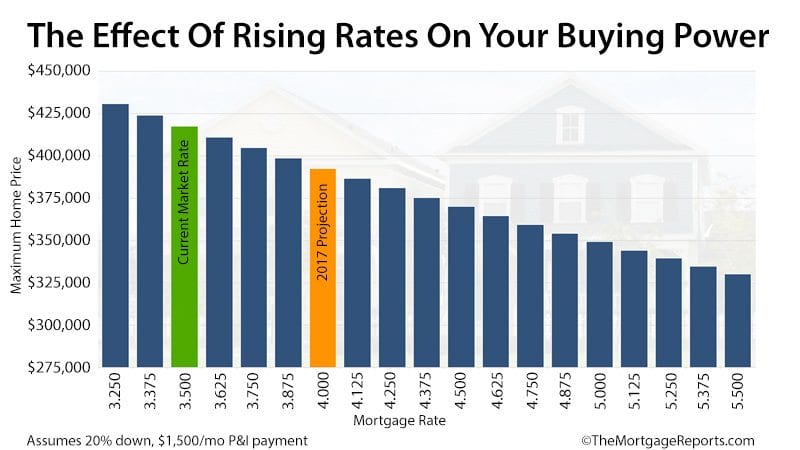

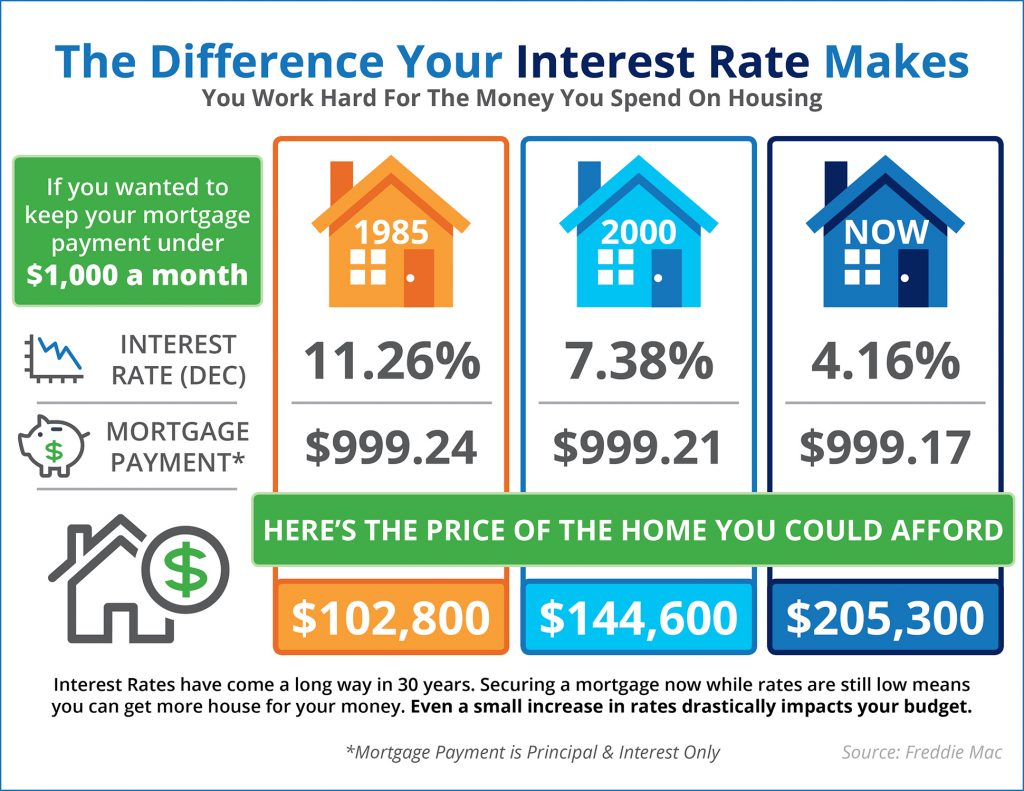

Interest rates represent the cost of borrowing money, often expressed as a percentage of the loan amount. These rates fluctuate based on various economic factors and can significantly influence home buying decisions. For potential buyers, a lower interest rate typically means lower monthly mortgage payments, making homeownership more accessible. Conversely, a rise in interest rates can squeeze some homebuyers out of the market or limit the purchasing power of others.

For example, imagine a couple dreaming about a cozy home in the suburbs. If the interest rate is at 3%, they might afford a $300,000 home comfortably. However, if rates rise to 4% or 5%, their affordability might drop, pushing the same home out of reach.

Historical Trends in Interest Rates

Looking back over the past few decades, interest rates have seen dramatic fluctuations.

- 1980s: Rates soared to as high as 18%.

- 1990s to 2000s: Rates gradually decreased, settling around 6-7%.

- Post-2008 Financial Crisis: Rates were drastically cut, hovering around 3-4% until recent years.

This historical context is essential for understanding current market dynamics. Today's rising interest rates are reminiscent of the volatility seen years ago, leading many first-time homebuyers to feel uncertain.

Relationship Between Interest Rates and Home Prices

The relationship between interest rates and home prices is crucial. As rates climb, the cost to borrow increases, often putting downward pressure on home prices.

When rates rise, potential buyers may:

- Delay their home purchase

- Opt for lower-priced homes

- Pull out of the market altogether

This ripple effect can stabilize or even reduce home prices in some markets, but the impact varies regionally. For instance, in hot markets, even rising rates may not sufficiently cool the demand. Understanding these dynamics helps buyers navigate their options wisely and make better-informed decisions.

Factors Influencing Mortgage Rates

Federal Reserve Policy

One of the primary drivers of mortgage rates is the monetary policy set by the Federal Reserve. This central banking system influences interest rates indirectly through its decisions regarding the federal funds rate, which is the interest at which banks lend to each other overnight. When the Fed raises the federal funds rate, borrowing costs increase, leading to higher mortgage rates.

For instance, after a recent Fed meeting, a friend of mine found his dream home but was taken aback as mortgage rates jumped by 0.5% overnight! This change significantly affected his monthly payments and his overall budget.

Economic Conditions

Economic health plays a crucial role in determining mortgage rates. A strong economy typically leads to higher demand for loans as consumer confidence and spending power rise. Conversely, during economic downturns, lenders may reduce rates to encourage borrowing. Key indicators include:

- Inflation: Higher inflation often results in increased rates.

- Employment Rates: Lower unemployment can lead to higher rates due to increased demand for housing.

- Gross Domestic Product (GDP): A growing GDP signals economic strength, which can drive rates up.

In recent years, fluctuations due to the pandemic showcased just how interconnected these elements can be.

Credit Score and Loan Type

Personal financial profiles are vital in shaping individual mortgage rates. Your credit score, which reflects your creditworthiness, directly influences the rate you receive. Here’s how it works:

- Excellent credit (740 and above): Often qualifies for the best rates.

- Good credit (700-739): Generally gets competitive rates.

- Fair credit (640-699): Faces higher rates and stricter lending terms.

Additionally, loan types matter. Conventional loans may offer different rates than FHA or VA loans based on risk assessments and government backing.

Understanding these factors empowers potential homebuyers to take proactive steps in securing the best possible mortgage rates, giving them a better chance of achieving their homeownership dreams.

Pros and Cons of Buying a Home in a Rising Interest Rate Environment

Benefits of Buying Now

While rising interest rates may seem intimidating, there are several benefits to buying a home now. First, locking in a mortgage can provide a sense of stability amidst an unpredictable market.

- Fewer Buyers: Higher rates may deter some potential buyers, leading to less competition in the housing market. This could mean better negotiation power for you.

- Potential for Price Stabilization: As interest rates increase, some home prices may stabilize or even decline slightly, presenting opportunities for savvy buyers to find value.

A colleague of mine recently seized the chance to buy a home in a less competitive market, ultimately saving thousands because fewer bids were placed on the property.

Challenges Faced by Homebuyers

However, with benefits come challenges. Buyers might encounter:

- Higher Monthly Payments: An uptick in interest rates translates directly to higher monthly mortgage payments, impacting affordability.

- Increased Down Payment Requirements: Lenders may require more substantial down payments to mitigate risks associated with higher interest loans.

- Potential for Market Volatility: The housing market can be unpredictable during rising rates, causing anxiety about whether purchasing now is wise.

A friend who bought just before a slight rate increase shared how it strained their monthly budget.

Long-Term Financial Implications

The long-term financial implications of buying in a rising interest rate environment must also be considered. While higher rates can increase initial costs, there are some silver linings:

- Tax Benefits: Mortgage interest may be deductible, offering some relief come tax season.

- Equity Growth: Over time, as home values typically appreciate, your initial investment can yield substantial returns, even if you paid a higher rate initially.

Navigating the complexities of buying a home while interest rates are on the rise requires careful analysis and planning, but for those willing to take the leap, the potential rewards can be significant.

🏡 Click here to browse Bay Area properties – Explore available homes and investment opportunities in the Bay Area today!

Tips for Navigating Home Buying in a Rising Interest Rate Market

Start by Researching Rates

Navigating the waters of home buying amidst rising interest rates starts with thorough research. Knowing the current mortgage rates gives you a yardstick to measure your options effectively.

- Track Rate Trends: Websites like Freddie Mac and Bankrate provide regular updates on rates, helping you spot patterns and anticipate changes.

- Set Rate Alerts: Many mortgage lender websites and financial platforms offer tools to alert you when rates fall or rise, so you can time your purchase wisely.

A friend of mine diligently tracked interest rates for months before finding her perfect home. When she noticed a slight dip, she acted fast, ultimately saving herself a significant amount over the loan term.

Explore Mortgage Options

Not all mortgages are created equal! With rising rates, it’s crucial to explore various mortgage options that may suit your financial situation.

- Fixed vs. Adjustable-Rate Mortgages: With a fixed-rate mortgage, your interest rate stays the same, providing predictable payments. Adjustable-rate mortgages may start with a lower interest rate but can increase over time.

- Specialized Programs: Look into government programs like FHA or VA loans, which may offer competitive rates and lower down payment requirements.

Consulting with a mortgage broker can also uncover hidden gems tailored to your needs.

Consider Housing Affordability

Finally, consider what housing affordability means for your situation. As interest rates rise, calculate how your budget aligns with potential mortgage payments.

- Use the 28/36 Rule: This guideline suggests that your housing costs should not exceed 28% of your gross monthly income, and your total debt payments should stay under 36%.

- Account for Extras: Don’t forget to factor in property taxes, insurance, and maintenance costs when assessing your budget.

By being realistic about your affordability, you can make informed decisions and avoid future financial strain. Adopting these strategies can empower you to successfully navigate home buying in a rising interest rate environment, turning challenges into opportunities!

📅 Click here to schedule a call – Have questions or need expert advice? Book a call with Graeham Watts today!

Case Studies: Real-Life Examples of Home Buying Decisions in Different Interest Rate Environments

Scenario 1: Low-Interest Rate Environment

Let’s take a look at a scenario where interest rates are low. Sarah and Tom, a young couple, decided to purchase their first home in 2020, a time when mortgage rates had hit historic lows, around 3%.

- Home Purchase: They found a charming three-bedroom house priced at $350,000.

- Monthly Payments: With a 30-year fixed mortgage at 3%, their monthly payment was approximately $1,480, comfortably fitting within their budget.

- Negotiation Power: The competitive market allowed them to negotiate closing costs, resulting in substantial savings.

By capitalizing on the low-interest environment, they not only secured a home within their financial means but also benefited from lower payments compared to previous years. Their financial foresight enabled them to build equity quickly, as home values continued to rise, making their purchase a stellar long-term investment.

Scenario 2: Rising Interest Rates

Now, consider the experience of James and Mia, who began their home search in early 2023, facing rising interest rates that climbed to around 5%.

- Purchase Challenges: Initially, they fell in love with a $400,000 home, but after calculating their mortgage at a 5% rate, their monthly payment soared to approximately $2,100.

- Budgeting Reality Check: Faced with affordability issues, they had to pivot and look for homes priced around $350,000 instead, leading to a different set of compromises.

Despite the challenges, James and Mia successfully purchased a cozy townhouse that met their needs, albeit with a higher interest rate. They quickly adapted their strategy—focusing on adjusting their budget and being more flexible with their home features.

These contrasting scenarios highlight how the interest rate environment plays a critical role in shaping home buying decisions. While low rates can encourage purchases, rising rates necessitate thoughtful planning and strategic adjustments to still achieve homeownership dreams.

Conclusion: Making Informed Decisions in a Changing Market

Recap of Key Points

As we’ve explored throughout this discussion, purchasing a home is undoubtedly a significant financial decision, influenced heavily by the current interest rate environment. Here are the key takeaways to keep in mind:

- Understanding Interest Rates: Low-interest rates encourage buying, while rising rates can limit affordability and necessitate more strategic planning.

- Factors Influencing Rates: Federal policies, economic conditions, and personal credit scores are critical in determining mortgage rates.

- Analyzing Pros and Cons: Buyers must weigh the benefits of entering the market now against the challenges presented by increased rates.

- Real-Life Case Studies: Examples of Sarah and Tom versus James and Mia illustrate how varying interest rates can affect home buying decisions and strategies.

Having a solid grasp of these points can empower prospective buyers to approach the market with confidence.

Future Outlook and Considerations

Looking forward, the housing market is expected to remain dynamic as interest rates fluctuate. While some experts predict potential stabilization in rates, others foresee more hikes depending on inflation and economic outlook.

Here are a few considerations for future homebuyers:

- Stay Informed: Regularly monitor market trends and economic indicators to make timely decisions.

- Plan Ahead: Plan your finances with potential rate increases in mind to avoid financial strain down the line.

- Consult Experts: Don’t hesitate to engage with real estate professionals and mortgage brokers for personalized advice and insights.

🏠 Click here for a free home evaluation – Thinking about selling? Find out your home’s value with a free assessment today!

By remaining proactive and well-informed, homebuyers can navigate the complexities of the market confidently, turning potential uncertainties into opportunities for future prosperity. Embrace this journey, and remember that informed decisions yield the best outcomes! 🏡✨

GRAEHAM WATTS

Lic#01466876

📲 650.308.4727

📩 graehamwatts@gmail.com

🌐www.graehamwatts.com

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION