Real Estate Market Update: Understanding Closing Costs Across Cities and Counties

Real Estate Market Update: Understanding Closing Costs Across Cities and Counties

In this Real Estate Market Update, we delve into the intricacies of closing costs and how they vary significantly depending on your location. From city to county, each area has its unique fees and taxes that every homebuyer should be aware of.

Understanding Closing Costs 💰

Closing costs represent a crucial aspect of real estate transactions. These costs encompass various fees and expenses that buyers and sellers must pay to finalize a property transfer. Understanding these costs is essential for anyone looking to navigate the real estate market effectively.

Typically, closing costs can include loan origination fees, title insurance, appraisal fees, and various taxes. The specifics can vary widely based on the location of the property, which is why knowing your local real estate landscape is vital.

In many cases, buyers are responsible for a significant portion of these costs, but sellers may also incur fees, particularly related to the transfer of ownership. This division of costs can depend on local customs, which can vary significantly from one county to another.

The Components of Closing Costs

- Loan Origination Fees: Charged by the lender for processing the loan.

- Title Insurance: Protects against any legal claims against the title.

- Appraisal Fees: Covers the cost of assessing the property's value.

- Recording Fees: Charged by the government for recording the property transfer.

- Transfer Taxes: Taxes imposed on the transfer of property ownership.

County Variations in Closing Costs 🏡

Closing costs are not uniform across the board. Each county has its own set of fees and regulations that impact how much buyers and sellers will need to pay at closing. Understanding these variations can save you money and prevent surprises during the closing process.

For instance, some counties may have higher title insurance rates, while others may impose additional transfer taxes. This can lead to significant differences in what you might expect to pay when closing a deal.

It's essential to research the specific closing costs associated with the county in which you are buying or selling property. Many counties provide detailed breakdowns of these costs on their official websites, making it easier for you to plan ahead.

Key Factors Influencing County Costs

- Local Tax Rates: Varying tax rates can significantly impact closing costs.

- Title and Escrow Fees: Different counties may charge different fees for these services.

- Market Conditions: The demand for real estate in a county can influence overall costs.

City-Specific Transfer Taxes 🌆

In addition to county-level charges, some cities impose their own transfer taxes. These city-specific taxes can add an additional layer of expense to your closing costs. Understanding these local taxes is crucial for accurate budgeting when buying property.

For example, cities like San Francisco and San Jose have unique transfer tax structures that differ from their respective counties. This can lead to a higher total cost for buyers in these areas compared to other cities.

Before finalizing a purchase, ensure you are aware of any city-specific transfer taxes that may apply. This can help you avoid unexpected financial burdens at closing.

Examples of City-Specific Taxes

- San Francisco: The city has a combined county and city transfer tax structure.

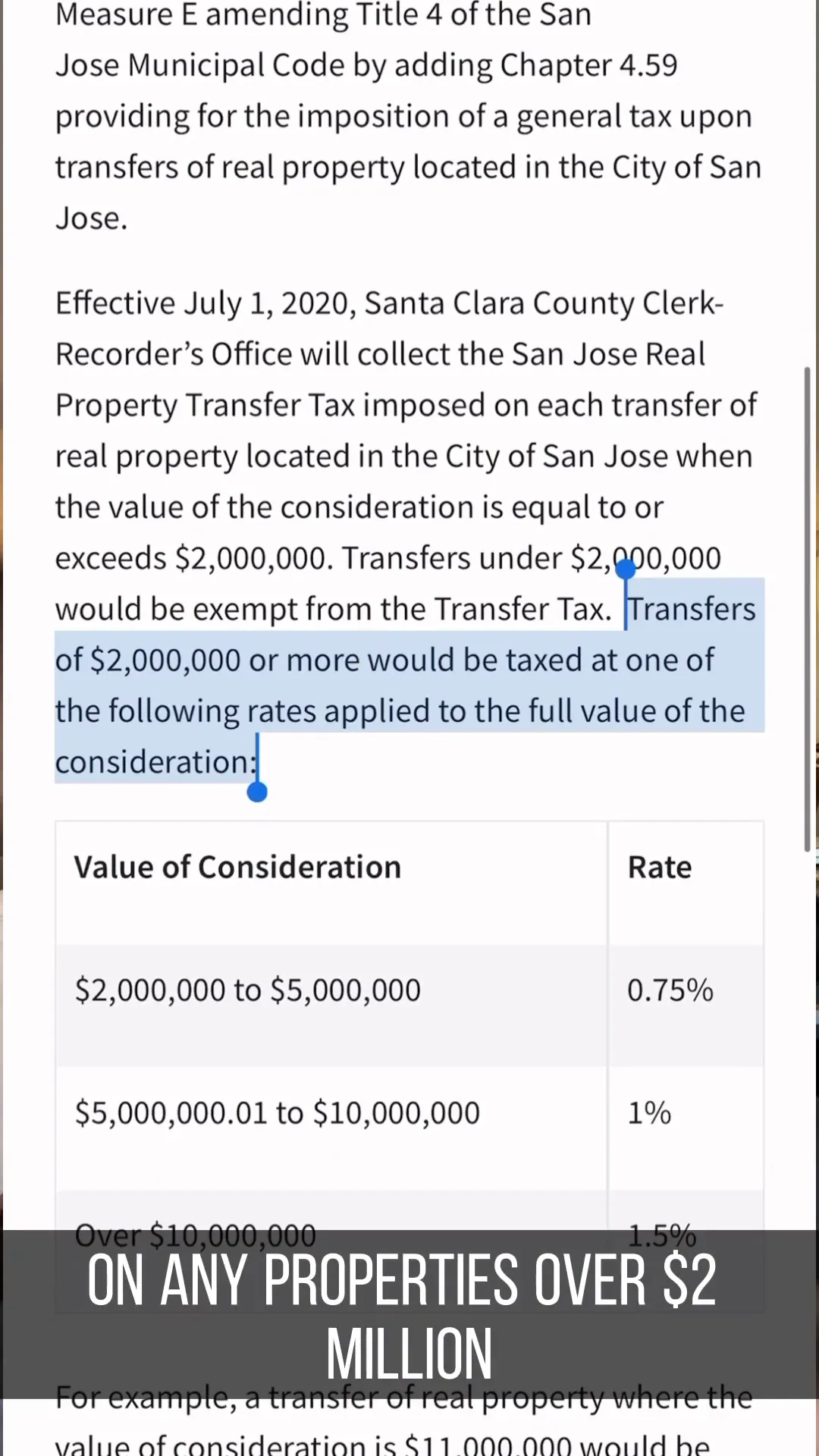

- San Jose: Recently implemented a transfer tax on properties over $2 million.

The Unique Case of San Francisco 🌉

San Francisco stands out due to its unique approach to closing costs and transfer taxes. Here, the county transfer tax is effectively merged with the city transfer tax, making it essential for buyers to understand this system.

The tax structure in San Francisco can be complex, with rates varying based on the property's sale price. Buyers should familiarize themselves with these rates early in the process to avoid surprises.

For properties valued between $250,000 and $1 million, the transfer tax rate is around $3.40 for every $500 of the sale price. This can result in significant costs, especially for higher-priced properties.

Understanding San Francisco's Tax Structure

- Tax Rate for Properties Under $1 Million: Approximately 0.68% of the sale price.

- For Properties Over $1 Million: The rate escalates, impacting overall closing costs substantially.

Transfer Tax Breakdown for San Francisco 📊

To navigate San Francisco's transfer tax landscape effectively, it's important to understand the specific rates and how they apply to various property price ranges. The structure can lead to significant financial implications for buyers.

For instance, a million-dollar property could incur transfer taxes ranging from $3,500 to $4,500. This amount can be a substantial component of the overall closing costs, which buyers must factor into their budgets.

Moreover, understanding how these taxes interact with other fees can provide a clearer picture of the total costs associated with purchasing property in San Francisco.

Tax Rates for Different Price Ranges

- Properties Under $1 Million: $3.40 per $500.

- Properties Between $1 Million and $5 Million: Rates increase progressively.

County Transfer Taxes in Other Areas 🌍

While San Francisco has a distinctive tax structure, other counties also impose their own transfer taxes. Understanding these taxes is crucial for buyers and sellers in various regions, as they can significantly impact overall closing costs.

In many counties, the seller typically pays the county transfer tax. However, this is not a universal rule, and buyers should clarify who is responsible for these taxes before closing.

It's advisable to consult local resources or real estate professionals to get a comprehensive understanding of the transfer taxes applicable in your area.

Examples of County Transfer Taxes

- Los Angeles County: Has its own set of transfer tax rates that can vary by city.

- San Diego County: Offers different rates based on property value and type.

San Jose's Additional Transfer Tax 🏙️

San Jose has introduced an additional layer of complexity with its own transfer tax, specifically targeting properties sold for over $2 million. This tax, known as Measure E, is designed to generate revenue for affordable housing initiatives within the city.

Understanding this tax is crucial for potential buyers in San Jose, as it can significantly impact the total closing costs. Unlike many other areas, where the seller typically bears the transfer tax burden, buyers in San Jose need to factor this additional cost into their budgets.

The implementation of this tax means that buyers should conduct thorough research before entering into a purchase agreement, ensuring they are fully aware of the financial implications of this local regulation.

Impact of Measure E on Buyers

- Budget Considerations: Buyers must account for this tax when calculating overall costs.

- Market Dynamics: This tax may influence market behavior, especially in high-value neighborhoods.

- Long-Term Implications: Understanding ongoing costs can help in long-term financial planning.

Understanding Lender Fees 💳

Lender fees are a critical component of closing costs that can often catch buyers off guard. These fees encompass various charges imposed by the mortgage lender for processing the loan and can vary widely by lender and loan type.

Common lender fees include loan origination fees, underwriting fees, and other administrative costs. It's essential for buyers to ask for a detailed breakdown of these fees upfront to avoid surprises later in the process.

Types of Lender Fees

- Loan Origination Fee: A percentage of the loan amount charged by the lender for processing the loan.

- Underwriting Fee: Charged for evaluating the loan application and determining the risk.

- Processing Fee: Covers the costs related to the paperwork and documentation required for the loan.

Simplifying the Closing Cost Process 📝

Closing costs can appear daunting, but breaking them down into manageable components can simplify the process for buyers. By understanding each element, buyers can better prepare for what to expect at closing.

Creating a checklist of potential costs can help keep track of various fees and ensure nothing is overlooked. Additionally, consulting with a real estate agent or financial advisor can provide clarity on what to anticipate in your specific market.

Steps to Simplify Closing Costs

- Request a Good Faith Estimate: This document outlines estimated closing costs and can provide a clearer picture of expected expenses.

- Ask Questions: Don’t hesitate to inquire about any fees that are unclear or seem excessive.

- Compare Offers: Look at closing costs from different lenders to find the best deal.

Resources for Homebuyers 📚

Homebuyers have access to a variety of resources that can aid in understanding and managing closing costs. From online calculators to local real estate workshops, these tools can provide valuable insights.

Additionally, many counties and cities maintain websites that provide detailed information about local taxes and fees. Familiarizing yourself with these resources can empower you to make informed decisions throughout the homebuying process.

Useful Resources

- Online Closing Cost Calculators: These tools can help estimate what you might pay at closing.

- Local Government Websites: Access detailed information about transfer taxes and fees specific to your area.

- Real Estate Workshops: Attend sessions that provide education on the homebuying process, including closing costs.

Frequently Asked Questions ❓

As you navigate the complexities of closing costs, you may have several questions. Here are some frequently asked questions that can help clarify common concerns.

Common Questions About Closing Costs

- What are closing costs? Closing costs are fees and expenses incurred during the finalization of a real estate transaction.

- Who pays for closing costs? Typically, buyers pay most closing costs, but this can vary by location and negotiation.

- How can I reduce closing costs? Comparing lender offers, negotiating fees, and understanding local regulations can help lower costs.

Understanding the intricacies of closing costs, including local variations like San Jose's transfer tax and lender fees, empowers homebuyers to navigate the real estate market more effectively. By utilizing available resources and asking the right questions, buyers can demystify the closing process and make informed financial decisions.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION