Real Estate Market Forecast: Busting the Foreclosure Myth

Real Estate Market Forecast: Busting the Foreclosure Myth

In today's Real Estate Market Forecast, we explore the truth behind the rising foreclosure rates and what it means for buyers, sellers, and investors. As mortgage bailouts end, many are left wondering if a surge in foreclosures is imminent, but the reality may be quite different.

📉 Introduction to Foreclosure Trends

The landscape of foreclosures is shifting, and understanding these trends is crucial. With the end of mortgage bailouts, many are left questioning the stability of the housing market. Are we on the verge of a foreclosure crisis, or are the numbers more manageable than they seem?

Recent Increases in Foreclosure Actions

Foreclosure actions have seen a significant uptick recently. In the second quarter of 2021, there was a staggering increase of almost 37%. By the third quarter, this number rose to nearly 67%. While these figures sound alarming, it’s essential to put them into perspective.

Before the pandemic, the average was about 40,000 new foreclosure actions per month. However, during the peak of the pandemic, this number dropped dramatically to just three to four thousand a month. Currently, an increase to 25,000 still remains below the pre-pandemic levels.

Understanding Pre-Pandemic Foreclosure Levels

To grasp the current situation, we must look back at pre-pandemic levels. Historically, the foreclosure market operated at a much higher volume. The drastic reduction during the pandemic was unprecedented, and now we are witnessing a return to those levels.

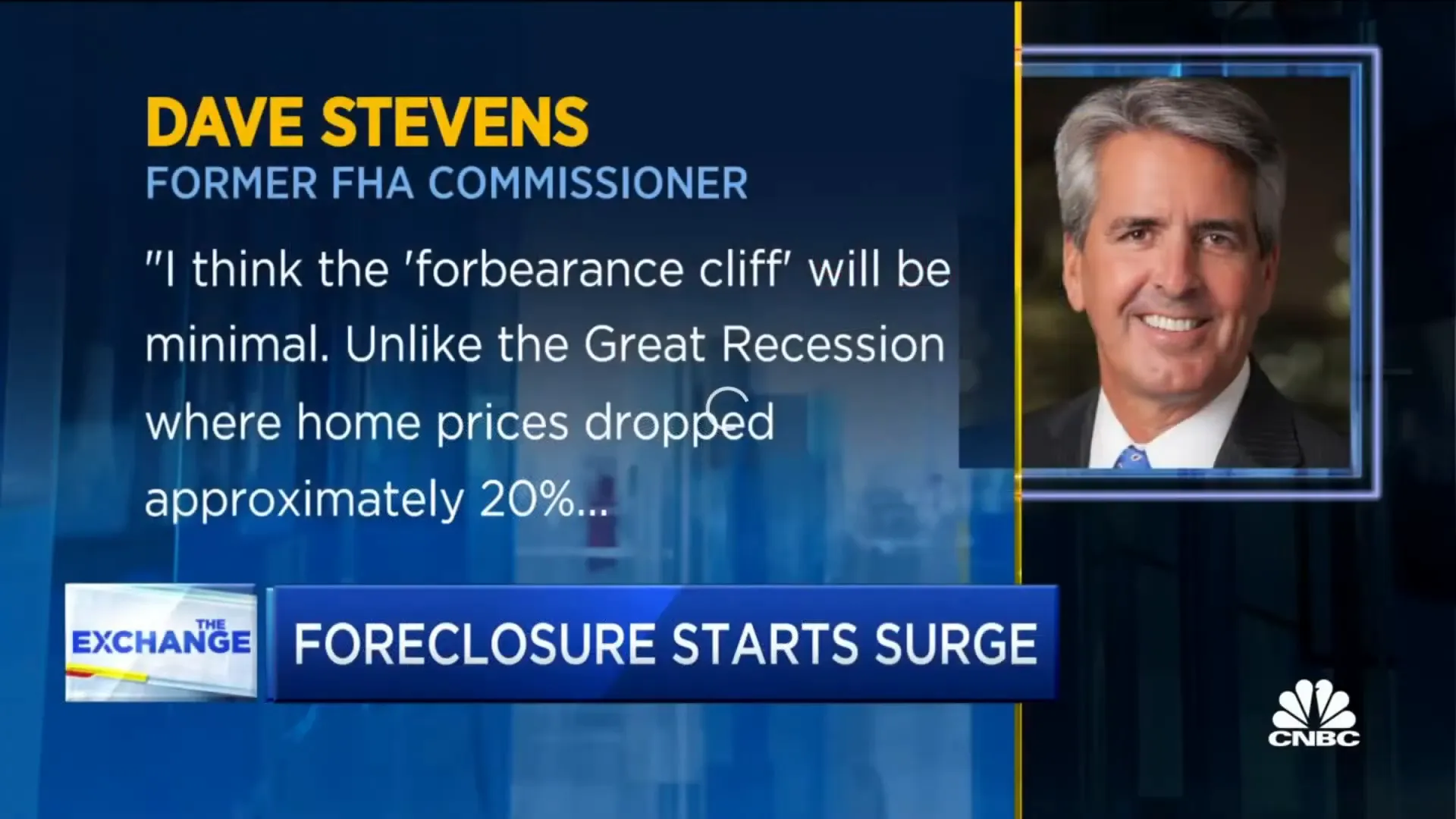

Expert Opinions on the 'Forbearance Cliff'

Experts like Dave Stevens, a former FHA commissioner, suggest that the so-called 'forbearance cliff' may not be as severe as anticipated. Unlike the Great Recession, which saw home values drop by about 20%, this recession has seen home values rise significantly.

This change means that homeowners unable to make payments can still sell their properties at a profit. This trend is not limited to homeowners; landlords also benefit from this scenario.

Options for Homeowners Facing Foreclosure

Homeowners facing foreclosure have several options available. Banks offer various solutions to prevent homes from entering foreclosure, including:

- Forbearance: Missed payments can often be added to the end of the loan.

- Loan Modifications: Adjustments can be made to the loan terms to make payments more manageable.

- Short Sales: Homeowners can sell their property for less than what is owed, with the bank agreeing to write off the difference.

- Deed in Lieu of Foreclosure: This involves returning the property to the bank instead of going through the foreclosure process.

Forbearance as a Preventative Measure

Forbearance has emerged as a significant tool for homeowners experiencing financial difficulty. It allows them to pause their mortgage payments temporarily, providing breathing room during tough times. This option has been crucial during the pandemic, helping millions avoid foreclosure.

Loan Modifications: A Viable Option?

Loan modifications represent another path for homeowners struggling with payments. These modifications can lower monthly payments or adjust interest rates, making it easier for homeowners to stay afloat. Historically, banks have engaged in loan modifications to help prevent foreclosures.

As we navigate these changing dynamics, understanding the options available can empower homeowners to make informed decisions. The current real estate market offers various pathways to avoid foreclosure, ensuring that most homeowners can find a solution that works for them.

🏠 Short Sales Explained

Short sales are a vital option for homeowners facing financial difficulties. In essence, a short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. This process requires the lender's approval, as they agree to accept the reduced amount as full payment.

Homeowners typically pursue short sales when they owe more than their home is worth and cannot keep up with mortgage payments. This option can prevent foreclosure and allow the homeowner to move on without the long-term impact of a foreclosure on their credit report.

To initiate a short sale, homeowners must provide their lender with a complete financial picture, including income, expenses, and a hardship letter explaining their situation. The lender will then assess whether to approve the short sale based on the homeowner's financial status and the property's current market value.

🔑 Understanding Deeds in Lieu of Foreclosure

A deed in lieu of foreclosure is another alternative for homeowners who can no longer afford their mortgage. This process involves the homeowner voluntarily transferring the property title back to the lender, effectively avoiding the lengthy foreclosure process.

One advantage of a deed in lieu is that it can be less damaging to a homeowner's credit score compared to a foreclosure. Additionally, it can expedite the process of settling the homeowner's debt, allowing them to move on more quickly.

However, lenders do not always accept deeds in lieu of foreclosure, especially if there are other liens on the property. Homeowners should consult with their lender to explore this option and understand the implications before proceeding.

📊 Current Market Conditions and Foreclosure Rates

The current real estate market reflects a complex interplay of factors influencing foreclosure rates. While there has been an increase in foreclosure actions, the actual numbers remain significantly lower than pre-pandemic levels.

As of now, there are still approximately 1.4 million homes in forbearance. This situation creates a buffer, as many homeowners have built equity over the past couple of years. With rising home values, most homeowners have options to avoid foreclosure.

Current foreclosure rates indicate a market stabilizing rather than spiraling into a crisis. Experts predict that the number of foreclosures will not reach the alarming levels seen in previous economic downturns.

🔮 Predictions for the Future of Foreclosures

Looking ahead, the outlook for foreclosures appears to be less severe than many anticipate. Various factors contribute to this optimistic forecast, including rising home equity and the availability of alternative options for distressed homeowners.

Experts suggest that the 'forbearance cliff' predicted by many may be overstated. With home values on the rise, homeowners facing financial hardship can often sell their properties at a profit, thus avoiding foreclosure altogether.

Given these dynamics, it is unlikely we will see a massive wave of foreclosures flooding the market. Instead, the market is expected to stabilize, benefiting both homeowners and potential buyers looking for opportunities.

💬 Community Engagement: Share Your Thoughts

We want to hear from you! How do you perceive the current state of the real estate market? Are you optimistic about the future of foreclosures and the options available for homeowners?

Your insights are valuable, and discussing these topics can help others navigate their own situations. Please share your thoughts in the comments below, and let's engage in a meaningful conversation about the real estate market forecast.

❓ FAQ: Common Questions About Foreclosures

What is a foreclosure?

A foreclosure occurs when a lender takes possession of a property due to the homeowner's failure to make mortgage payments. This process allows the lender to recover the remaining balance owed on the mortgage.

How does a short sale work?

A short sale involves selling the property for less than the mortgage balance, with the lender's approval. The lender agrees to accept the reduced amount as full payment, allowing the homeowner to avoid foreclosure.

What is a deed in lieu of foreclosure?

A deed in lieu of foreclosure is when a homeowner voluntarily transfers the property title back to the lender. This process can help avoid the lengthy foreclosure process and may have less impact on the homeowner's credit score.

Are foreclosure rates expected to rise?

While there has been an increase in foreclosure actions, experts predict that rates will not reach the alarming levels seen in past economic downturns. The current market conditions and available options for homeowners suggest a more stable future.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION