Essential Home Buying Tips: Navigating Contingencies with Confidence

Hey future homeowners! 🎉 You're on the verge of making one of the biggest decisions of your life, and we're here to arm you with essential Home Buying Tips. In this blog, we'll dive deep into the crucial contingencies you need to know about when your offer gets accepted—ensuring a smooth ride to your dream home! 🏠

Introduction to Contingencies 📝

Welcome to the critical phase of your home buying journey! When your offer is accepted, it's time to dive into contingencies. Think of contingencies as your safety net—they're essential to protect you from unexpected surprises as you navigate this process.

In this section, we’ll cover the three major contingencies you’ll encounter: your loan, your appraisal, and your inspection. Understanding these will empower you to make informed decisions and avoid pitfalls. Let's get into the nitty-gritty!

Understanding the Three Major Contingencies 📊

So, what are these three major contingencies? Let's break them down:

- Loan Contingency: This is your assurance that your financing will be approved. If your loan doesn't go through, you can walk away from the deal without penalties.

- Appraisal Contingency: This protects you from overpaying for a property. If the home appraises for less than your offer, you can negotiate or back out.

- Inspection Contingency: This allows you to have the property inspected. If significant issues arise, you can request repairs, negotiate costs, or even withdraw your offer.

By understanding these contingencies, you're setting yourself up for success. They’re not just legal jargon; they’re your shield in the home buying process!

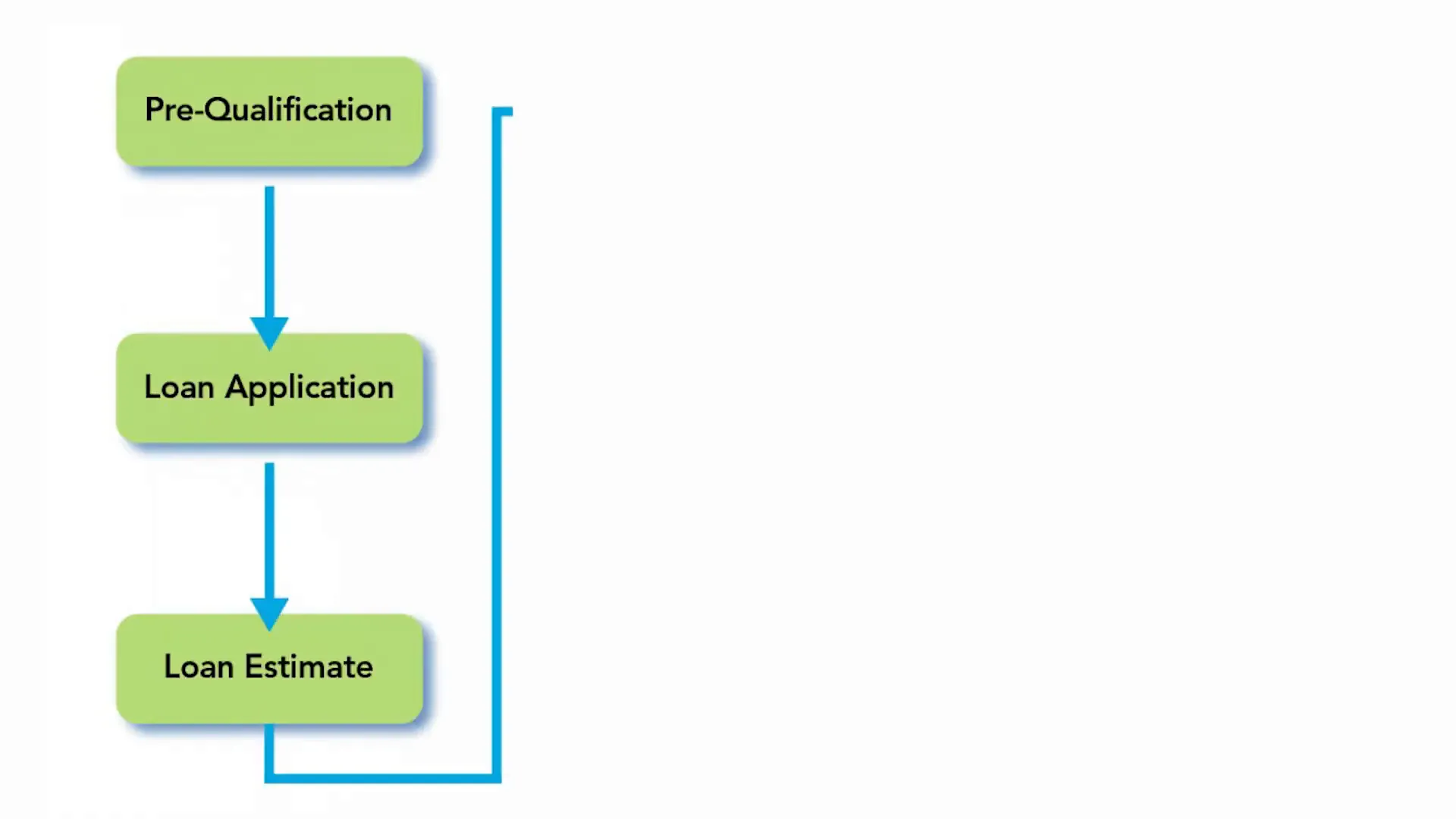

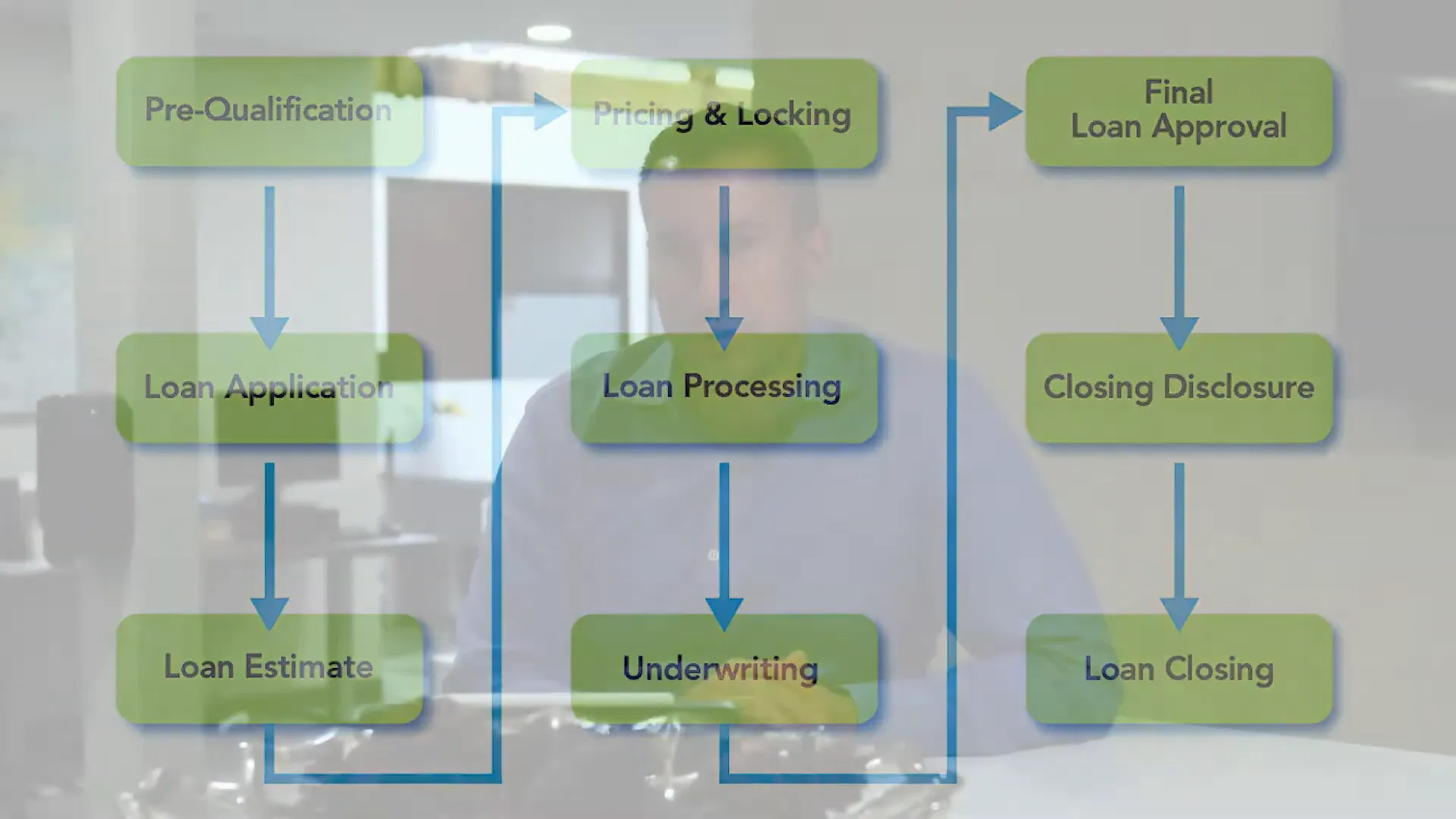

Navigating the Loan Process 💰

Next up, the loan process! This can feel like a maze, but don’t worry, I’m here to help you navigate through it. Start by getting pre-approved. This not only gives you a clear picture of your budget but also shows sellers you're a serious buyer.

Once your offer is accepted, you’ll work closely with your lender to finalize the details. Expect to provide documentation like tax returns, pay stubs, and bank statements. The more organized you are, the smoother this process will be!

The Importance of Appraisal 🚪

Now, let’s talk about appraisals. An appraisal is a professional assessment of a property's value. It’s crucial because it ensures you’re not overpaying for your new home. If the appraised value comes in lower than your offer, it can create tension in the transaction.

But fear not! This is where your appraisal contingency shines. If there’s a discrepancy, you have options. You can negotiate with the seller to lower the price or even walk away if needed. Remember, knowledge is power!

What Happens If Your Property Doesn't Appraise? ⚠️

Ah, the million-dollar question! If your property doesn’t appraise at the agreed-upon price, it can feel like hitting a brick wall. But don’t panic! You have several paths to consider.

- Negotiate the Price: You can go back to the seller and negotiate a lower price based on the appraisal.

- Cover the Difference: If you're in love with the property, you might decide to pay the difference out of pocket.

- Walk Away: If the appraisal is significantly lower, you might choose to walk away without penalty, thanks to your appraisal contingency.

Ultimately, having a solid understanding of these options will give you the confidence to make the best decision for your situation. Remember, you're not alone in this—I'm here to guide you every step of the way!

Tips for Dual Applications through Lenders 🔄

When it comes to securing your dream home, the last thing you want is an appraisal hiccup. To minimize this risk, consider the strategy of running dual applications through two different lenders. This is a proactive approach that can save you a lot of headaches down the road.

Why dual applications, you ask? Well, it spreads out the risk! By using two different lenders, you engage two separate appraisers, which increases your chances of getting a favorable appraisal. This means you won’t be left holding the bag if one lender's appraisal doesn't meet your expectations.

How to Execute Dual Applications 📝

Executing dual applications is straightforward, but it requires some organization. Here’s how to do it:

- Choose Reputable Lenders: Research and select two lenders known for their reliability and good customer service.

- Gather Your Documentation: Prepare your financial documents like W-2s, bank statements, and pay stubs, as you'll need to submit these to both lenders.

- Apply Simultaneously: Complete applications with both lenders at the same time. This ensures you’re on the same timeline and can compare offers easily.

- Communicate Openly: Keep both lenders informed about your application status, and don’t hesitate to ask questions if something seems unclear.

By following these steps, you’re setting yourself up for a smoother loan process. Remember, knowledge is power, and being well-prepared will give you the confidence to navigate the complexities of home buying!

Closing with Confidence 🎉

After navigating the loan process and appraisal concerns, it's time to talk about closing! This is where all your hard work pays off, and you officially become a homeowner. But how do you ensure you close with confidence?

First and foremost, review all closing documents carefully. Make sure everything aligns with what you discussed, including loan terms, closing costs, and any contingencies. If something looks off, don’t hesitate to ask questions. Remember, this is your investment, and you deserve clarity!

What to Expect at Closing 🖊️

Closing day can be a whirlwind, but knowing what to expect can help ease any nerves. Here’s a quick rundown of the process:

- Final Walkthrough: Before closing, you’ll have a final walkthrough of the property to ensure everything is as it should be.

- Signing Documents: You'll sign a mountain of paperwork—don’t worry, it’s mostly formalities! Just make sure you understand each document before signing.

- Payment of Closing Costs: Be prepared to pay your closing costs, which may include lender fees, title insurance, and escrow fees.

- Getting Your Keys: Once the paperwork is signed and funds are transferred, you’ll receive the keys to your new home. Cue the happy dance!

Closing can feel overwhelming, but with the right preparation, you can approach it with confidence. Just think about the exciting journey ahead as a new homeowner!

Post-Closing Support 🤝

Congratulations! You’ve closed on your home, but the journey doesn’t end here. Post-closing support is crucial to ensure you're settling in smoothly and making the most of your new investment.

As your trusted guide, I’m here to support you even after the closing table. Whether you have questions about home maintenance, need recommendations for local services, or just want to chat about your new neighborhood, I’m just a call away!

Ongoing Resources and Assistance 🏡

Don’t forget that being a homeowner comes with ongoing responsibilities. Here are a few tips to keep in mind:

- Stay Organized: Keep all your home-related documents in one place—think warranties, insurance policies, and maintenance records.

- Regular Maintenance: Schedule routine maintenance checks to keep your home in top shape and avoid costly repairs down the line.

- Explore Your Community: Take the time to get to know your new neighborhood. Local events, parks, and services can help you feel more at home.

Remember, I’m here to help you navigate this new chapter. Whether it's a quick question or a more complex issue, don’t hesitate to reach out!

Stay Connected for More Home Buying Tips 📞

As you embark on your homeownership journey, remember that I’m here for you every step of the way. Whether you’re a first-time buyer or a seasoned homeowner, there’s always more to learn about maintaining and enhancing your investment.

Stay connected for more home buying tips! Subscribe to my newsletter, follow me on social media, and feel free to reach out anytime. I love sharing insights that can help you make informed decisions and enjoy your home to the fullest!

After all, home buying doesn’t have to be a solo journey. Let’s navigate this exciting adventure together!

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION