Real Estate Market Update: Unlocking Investment Opportunities

Real Estate Market Update: Unlocking Investment Opportunities

In this Real Estate Market Update, we explore lucrative investment opportunities beyond the Bay Area, where cash flow potential can soar. Join Graeham Watts as he shares essential websites and insights to help you maximize your property investments.

🏡 Introduction to Real Estate Investing

Investing in real estate offers a unique opportunity to build wealth. Unlike traditional investments, real estate can provide tangible assets that generate cash flow. This sector has shown resilience over time, making it an appealing choice for many investors.

Understanding the fundamentals of real estate investing is crucial. It involves purchasing properties with the intent to earn returns through rental income, resale, or both. The key is to identify markets with high potential for growth.

For those new to the field, starting with a solid foundation in the basics can lead to informed decisions and successful investments.

Key Concepts in Real Estate Investing

- Cash Flow: The net amount of cash being transferred into and out of your investment. Positive cash flow properties generate more income than expenses.

- Appreciation: The increase in property value over time. This can significantly impact your investment returns.

- Equity: The difference between the market value of a property and the amount owed on the mortgage. Building equity is essential for leveraging investments.

💰 The Cash Flow Advantage

One of the most appealing aspects of real estate investing is cash flow. Properties that generate consistent rental income can provide financial stability and growth. Understanding how to maximize cash flow is key to a successful investment strategy.

Investors often seek properties in markets where rental income significantly exceeds expenses. This creates a positive cash flow scenario, allowing for reinvestment and further growth.

Cash flow can be influenced by various factors, including location, property type, and market trends. Analyzing these elements can help investors identify the best opportunities.

Strategies to Enhance Cash Flow

- Invest in High-Demand Areas: Properties in desirable neighborhoods typically command higher rents, contributing to better cash flow.

- Consider Multi-Unit Properties: Duplexes, triplexes, or apartment buildings can provide multiple streams of income.

- Optimize Rent Pricing: Regularly reassess rental rates to ensure they align with market trends.

🏘️ Leveraging Home Equity

Home equity can serve as a powerful financial tool for real estate investors. By leveraging the equity in your primary residence, you can access funds to invest in additional properties.

Refinancing your home or taking out a second mortgage are common methods to access this equity. These funds can then be used to purchase investment properties, thereby increasing your portfolio.

However, it’s essential to approach this strategy with caution. Understanding the risks and ensuring you can manage additional debt is crucial for long-term success.

Benefits of Leveraging Home Equity

- Increased Investment Potential: Accessing equity allows for larger investments, potentially leading to greater returns.

- Tax Benefits: Interest on loans taken for investment properties may be tax-deductible.

- Improved Cash Flow: Additional properties can generate more rental income, enhancing overall cash flow.

🔍 Researching Investment Locations

Choosing the right location for investment is critical. The success of your real estate venture largely depends on market conditions and local trends. Thorough research can help identify promising areas.

Consider factors such as job growth, population trends, and economic stability when evaluating potential locations. Areas with increasing demand often yield better returns.

Utilizing online resources and local market analyses can provide valuable insights into the best investment opportunities.

Key Factors to Analyze

- Job Market: Look for areas with strong job growth and diverse employment opportunities.

- Population Growth: Increasing populations can drive demand for housing, impacting rental prices positively.

- Local Amenities: Proximity to schools, shopping, and public transport can enhance property desirability.

🌐 RealWealth.com: A Comprehensive Resource

RealWealth.com is an invaluable tool for real estate investors. This platform provides comprehensive data on various markets, helping investors make informed decisions.

The website offers insights into average sales prices, rental income, job growth, and city demographics. This information can be instrumental in identifying lucrative investment opportunities.

By utilizing resources like RealWealth.com, investors can better assess potential markets and align their strategies with current trends.

Utilizing RealWealth.com Effectively

- Market Comparisons: Compare different cities to find the best cash flow opportunities.

- Demographic Insights: Understand the population dynamics that can affect rental demand.

- Investment Strategies: Access articles and guides to refine your investment approach.

Incorporating these strategies and resources into your real estate investment plan can significantly enhance your chances of success. By focusing on cash flow, leveraging equity, and conducting thorough market research, you can navigate the complexities of real estate investing with confidence.

📊 BiggerPockets.com: Market Insights

BiggerPockets.com stands out as a valuable resource for real estate investors seeking market insights. This platform offers a wealth of information, including the top 10 markets for cash flow in 2023. Understanding these markets can help investors make informed decisions.

One of the key features of BiggerPockets is the rent-to-sales price ratio. This metric gives a quick overview of how well a property can perform in terms of rental income relative to its purchase price.

While the data may not be exhaustive, it serves as a solid starting point for evaluating potential investments. Investors can leverage this information to narrow down their options and focus on markets that align with their financial goals.

Benefits of Using BiggerPockets

- Market Comparisons: Easily compare different cities and their cash flow potential.

- Community Support: Engage with a community of investors to share experiences and strategies.

- Educational Resources: Access articles, podcasts, and forums to enhance your real estate knowledge.

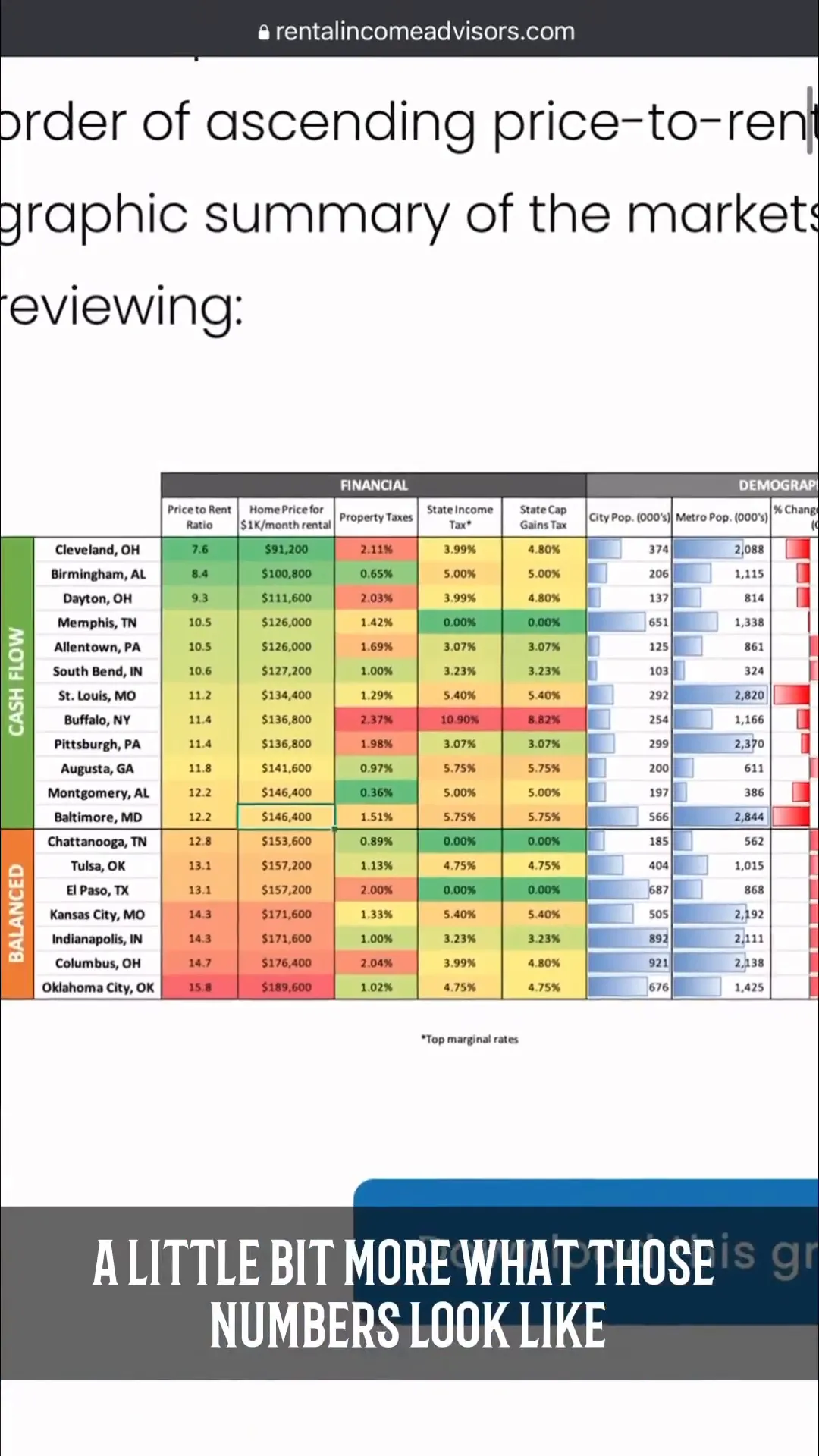

📈 RentalIncomeAdvisors.com: Detailed Analysis

For a more comprehensive analysis, RentalIncomeAdvisors.com is another excellent resource. This website provides an in-depth look at the top 12 cash flow markets for 2023, breaking down essential metrics like price-to-rent ratios.

Such thorough analysis allows investors to visualize potential returns and assess risk more effectively. Understanding these ratios can help in determining whether a market is worth investing in or not.

Moreover, the site features tools and calculators that can assist in making projections based on current market trends. This level of detail can be a game-changer for serious investors looking to maximize their cash flow.

Key Features of RentalIncomeAdvisors

- Comprehensive Data: Access detailed statistics on various markets, including rental income and property prices.

- Investment Tools: Utilize calculators to estimate potential returns and assess investment viability.

- Market Trends: Stay updated on the latest trends that could influence your investment strategy.

📝 Making Informed Investment Decisions

With the insights gained from these platforms, investors can make informed decisions that align with their financial goals. Analyzing cash flow potential and market conditions is critical in today’s competitive landscape.

It's not just about finding a property; it's about finding the right property in the right market. This strategic approach increases the likelihood of achieving positive cash flow and long-term appreciation.

Additionally, diversifying your investments across different markets can spread risk. By leveraging the data from resources like BiggerPockets and RentalIncomeAdvisors, you can identify promising areas beyond your local market.

Steps for Making Informed Decisions

- Research Thoroughly: Utilize multiple resources to gather data on various markets.

- Evaluate Metrics: Focus on key performance indicators such as cash flow, appreciation potential, and market stability.

- Consult Experts: Engage with local real estate professionals for insights that might not be available online.

📞 Call to Action

Are you ready to take your real estate investing to the next level? By leveraging the insights and tools discussed, you can unlock new investment opportunities that align with your financial goals.

If you'd like to delve deeper into how to leverage your property for more cash flow, don't hesitate to reach out. The right guidance can make all the difference in your investment journey.

Contact me today to explore the best strategies tailored to your needs. Let's work together to maximize your real estate investments!

❓ FAQ Section

What is cash flow in real estate investing?

Cash flow refers to the net amount of money generated from a property after all expenses are deducted. Positive cash flow indicates that the property earns more than it costs to operate.

How can I find the best markets for cash flow?

Utilize resources like BiggerPockets and RentalIncomeAdvisors to analyze various markets. Look for metrics such as rental income, property prices, and job growth to identify high-potential areas.

What should I consider when leveraging home equity?

Consider the risks involved, your ability to manage additional debt, and the potential returns on investment. Ensure you have a clear plan for how to utilize the funds effectively.

Is it better to invest locally or in out-of-state markets?

It depends on your investment strategy. Investing locally may offer familiarity, while out-of-state markets can provide better cash flow opportunities. Assess both options based on your goals and market research.

How often should I reassess my rental pricing?

Regular reassessment is essential, ideally at least once a year or when market conditions change. Staying competitive ensures you maximize your rental income.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION