Real Estate Market Update: Strategies for Homebuyers

Real Estate Market Update: Strategies for Homebuyers

In this Real Estate Market Update, Graeham Watts uncovers unique strategies to help you find your dream home. Discover how a tailored approach can make all the difference in today's competitive market.

🏡 Introduction to Home Buying

Buying a home is more than just a transaction; it's a significant life event. Understanding the home buying process can empower you and lead to better decisions. With the right guidance, you can navigate the complexities of the Real Estate Market Update with confidence.

At the heart of home buying is preparation. Knowing what you want, your budget, and your desired location are essential first steps. However, many buyers overlook the importance of having a knowledgeable agent who can provide insights and strategies tailored to your needs.

Key Steps in the Home Buying Process

- Assess Your Needs: Determine what features are must-haves versus nice-to-haves.

- Get Pre-Approved: Understand your financial capacity and what you can afford.

- Choose the Right Agent: Find an agent who understands your needs and the local market.

- Start Your Search: Use various resources to find listings that match your criteria.

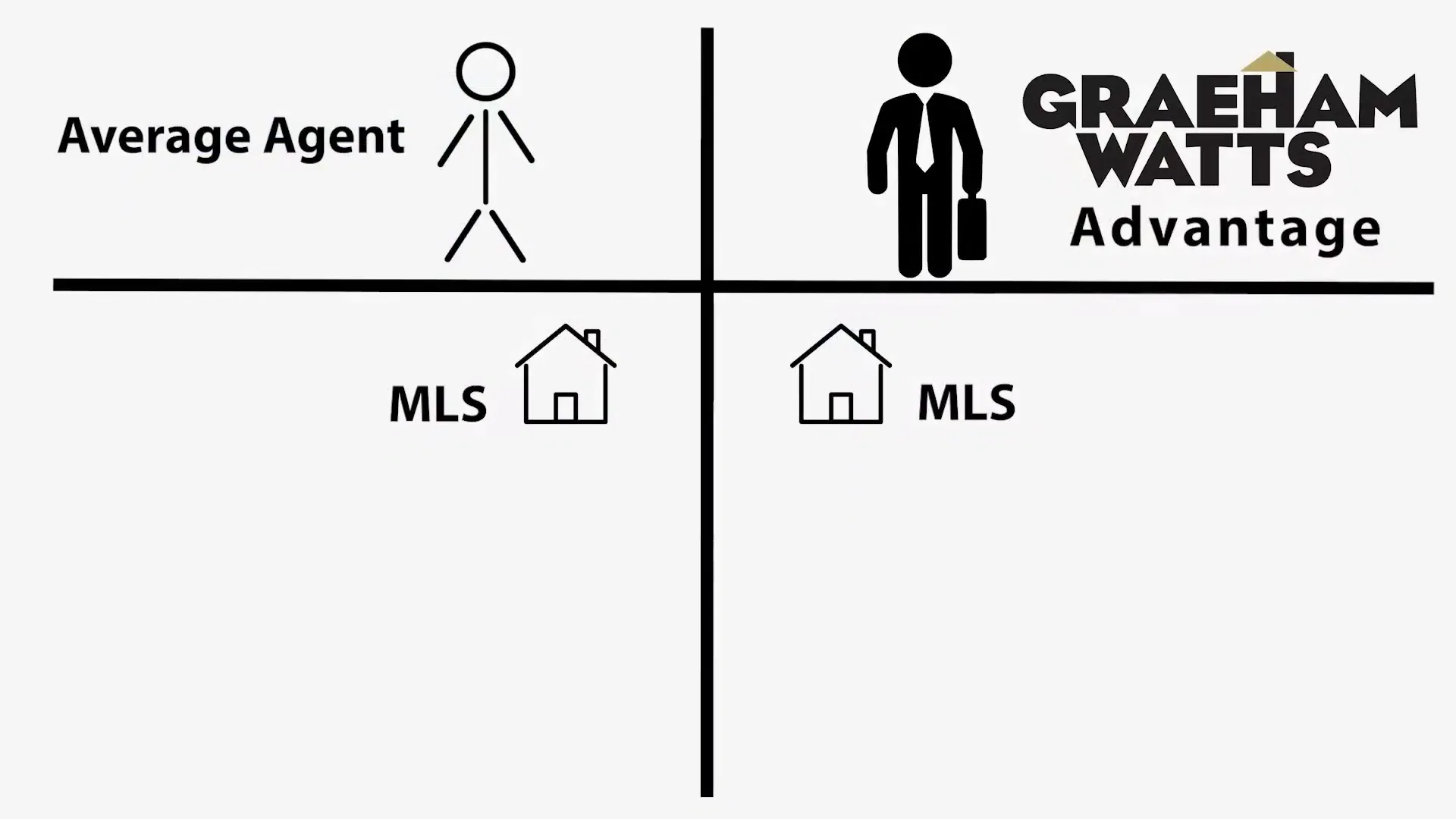

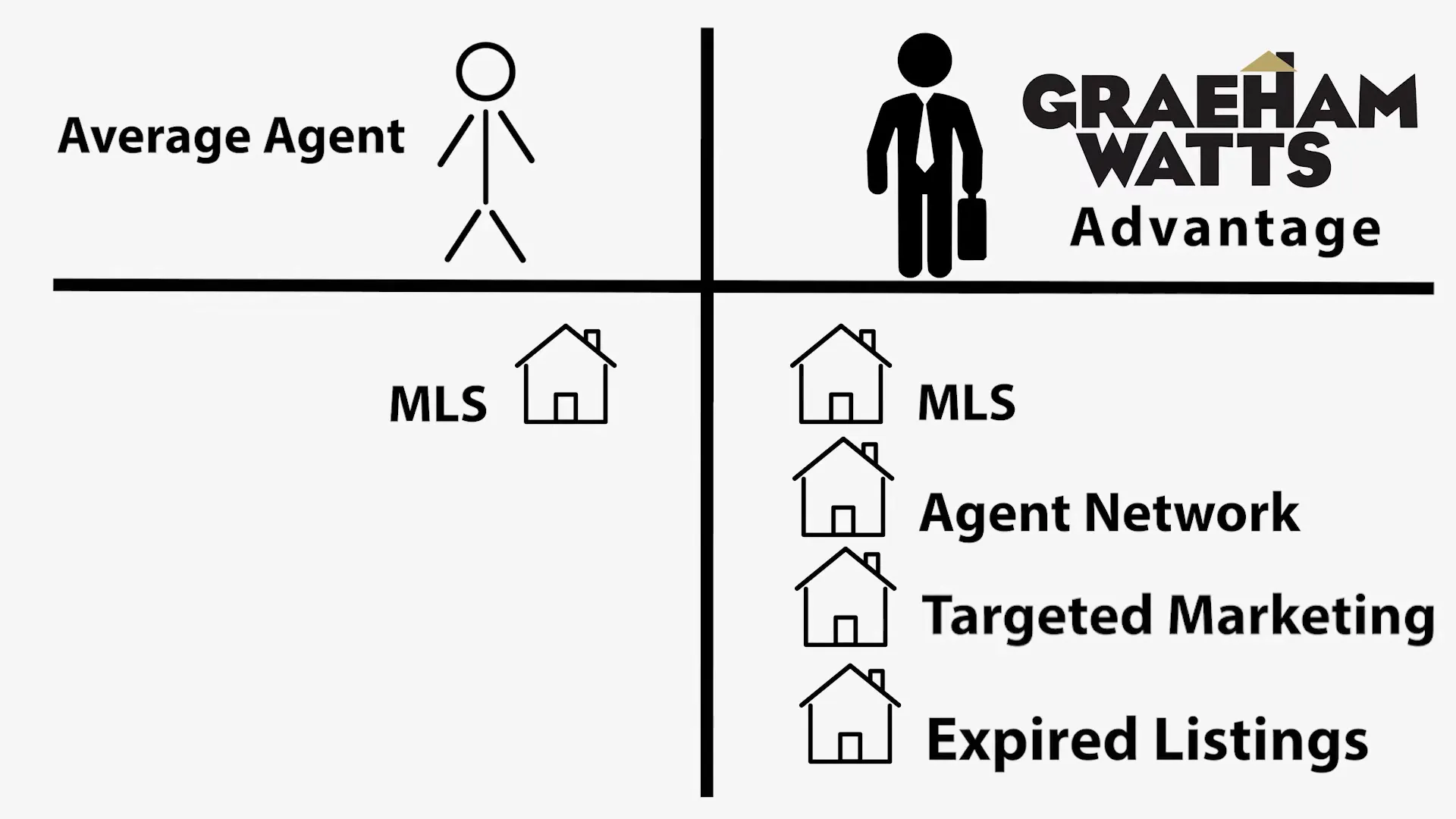

🕵️♂️ Understanding the Average Agent's Approach

Most agents rely heavily on the Multiple Listing Service (MLS) to find properties. This conventional method can limit options and lead to missed opportunities. While MLS is a valuable tool, it's essential to consider a broader approach.

Average agents often stick to listings that are readily available, which may not include off-market opportunities. This can be a significant disadvantage in today's competitive landscape. A proactive strategy can uncover hidden gems that others may overlook.

What Sets Us Apart

- Broader Network: We tap into a vast network of agents, not just local ones.

- Proactive Outreach: We reach out directly to homeowners before properties hit the market.

- Data-Driven Decisions: We analyze data beyond MLS to identify potential opportunities.

🔗 Leveraging the Agent Network

Our strategy involves connecting with agents across the county. This allows us to access properties before they are listed on the MLS. By tapping into our network, we gain insights and early access that can make a significant difference in your home buying experience.

Collaboration with agents who have exclusive listings can provide a competitive edge. Networking means more than just making calls; it's about building relationships that can lead to opportunities.

Benefits of a Strong Agent Network

- Early Access: Get notified about listings before they become public.

- Exclusive Information: Understand market trends and pricing strategies.

- Negotiation Power: Leverage relationships to negotiate better deals.

🏠 Targeting Homeowners Directly

To find potential homes, we employ direct outreach to homeowners. This strategy includes sending personalized postcards and making phone calls. By targeting specific areas, we can connect with homeowners who may be considering selling.

This approach not only broadens your options but also allows for a more personalized touch. Homeowners appreciate knowing that there is genuine interest in their property, which can lead to fruitful conversations.

Effective Outreach Techniques

- Direct Mail Campaigns: Sending tailored postcards to homeowners.

- Phone Outreach: Calling homeowners to discuss potential interest in selling.

- Door Knocking: Engaging with homeowners directly in their neighborhoods.

📉 Utilizing Expired Listings

Expired listings can be a treasure trove for homebuyers. These properties have gone unsold for various reasons, often presenting opportunities for negotiation. By analyzing expired listings, we can identify homes that may still meet your criteria.

Many homeowners are still motivated to sell, even if their property didn’t sell initially. Understanding their situation allows us to approach them with tailored solutions that may reignite their interest in selling.

Strategies for Working with Expired Listings

- Research Past Listings: Analyze why the property didn’t sell.

- Engage with Homeowners: Reach out to see if they are still interested in selling.

- Present New Strategies: Offer fresh marketing ideas to help them succeed this time.

🤝 Negotiation Tactics for Buyers

In today's competitive market, mastering negotiation tactics is crucial for buyers. Successfully negotiating can save you thousands and ensure you secure the home you desire without overextending your budget.

One effective tactic is to understand the seller's motivation. If you can identify why they are selling, you can tailor your offer to meet their needs. This could involve being flexible with closing dates or accommodating their timeline.

Key Negotiation Strategies

- Do Your Research: Know the market value of the property and recent sales in the area.

- Build Rapport: Establish a connection with the seller to create a positive atmosphere.

- Make a Strong Offer: Present a competitive offer that reflects the property's value.

- Be Ready to Walk Away: Show that you are serious but have alternatives if the deal doesn't meet your expectations.

💰 Special Loan Programs

Special loan programs can significantly impact your purchasing power. By leveraging these options, you may find yourself in a better financial position, allowing for a more comfortable home buying experience.

Many programs offer lower interest rates or reduced fees, making homeownership more accessible. It's essential to explore these opportunities and determine which ones align with your financial situation.

Types of Special Loan Programs

- FHA Loans: Designed for low to moderate-income buyers, these loans require lower down payments.

- VA Loans: Available for veterans and active military members, offering favorable terms and no down payment.

- USDA Loans: Ideal for rural properties, these loans offer 100% financing for eligible buyers.

- First-Time Homebuyer Programs: Various state and local programs provide assistance to those purchasing their first home.

👉 Next Steps for Interested Buyers

If you're ready to take the next step in your home buying journey, here’s how to proceed. Each step is vital for ensuring you are prepared and informed throughout the process.

Start by reaching out for a consultation to discuss your needs and preferences. This initial meeting will set the foundation for your home search and clarify the strategies we will employ.

Steps to Take

- Schedule a Consultation: Meet to discuss your goals and timeline.

- Get Pre-Approved: Secure a pre-approval letter to strengthen your position as a buyer.

- Define Your Criteria: Identify what you want in a home and your preferred neighborhoods.

- Start the Search: Begin viewing properties that match your criteria.

📝 Conclusion

In conclusion, navigating the Real Estate Market Update requires a strategic approach. By employing unique tactics, utilizing special loan programs, and preparing effectively, you can enhance your home buying experience.

Your dream home is within reach. With the right guidance and resources, you can make informed decisions and secure the property that meets your needs.

❓ FAQs about Home Buying

What is the first step in the home buying process?

The first step is to assess your needs and get pre-approved for a mortgage. This will provide clarity on your budget and what you can afford.

How do I know if I'm ready to buy a home?

Consider your financial stability, job security, and long-term plans. If you have a stable income and savings for a down payment, you may be ready.

What are closing costs, and how much should I expect to pay?

Closing costs are fees associated with the purchase of a home, typically ranging from 2% to 5% of the loan amount. These can include appraisal fees, title insurance, and loan origination fees.

Can I negotiate the price of a home?

Yes, negotiation is a common part of the home buying process. Understanding the market and the seller's motivations can help you secure a better price.

What should I look for during a home inspection?

Pay attention to the roof, plumbing, electrical systems, and any signs of water damage. A thorough inspection can reveal potential issues that may require costly repairs.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION