Real Estate Market Forecast: Fed Rate Cuts and the 2025 Housing Market

The landscape of the real estate market is shifting, and the latest Federal Reserve interest rate cuts are a pivotal part of this transformation. As we look ahead to 2025, understanding the implications of these changes is crucial for buyers, sellers, and investors alike. In this post, we’ll delve into the current state of the economy, the housing market, and what you need to know to make informed decisions.

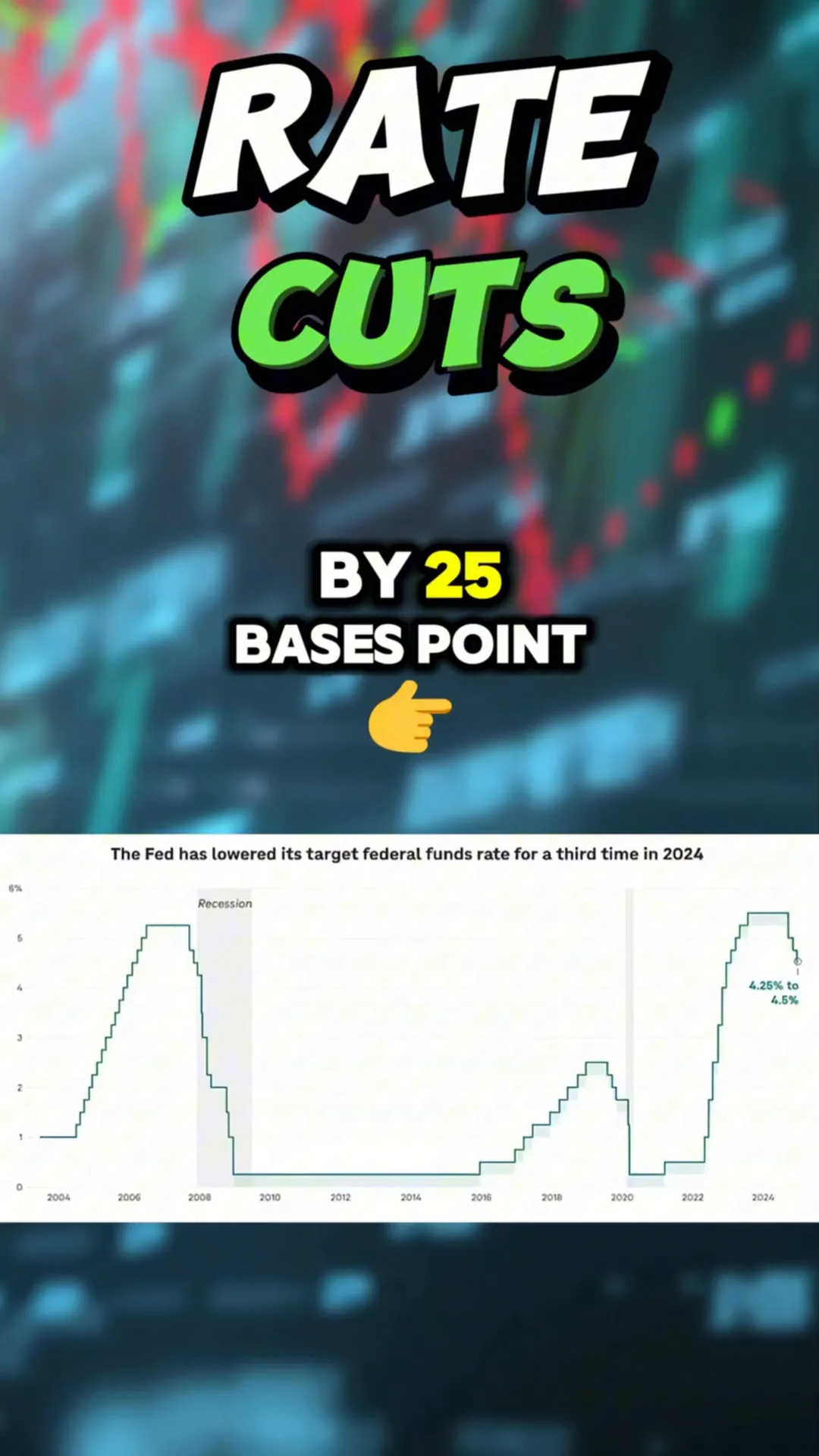

📉 Understanding the Fed's Rate Cuts

The Federal Reserve has recently trimmed its interest rates by 25 basis points, bringing the new range to between 4.25% and 4.5%. This adjustment marks the third consecutive cut, signaling a shift towards a less restrictive monetary policy. What does this mean for you? It’s a step back to levels we saw in December 2022, indicating a more favorable environment for both buyers and sellers.

Lower interest rates generally translate to better financing options. For buyers, this means lower monthly mortgage payments. For sellers, an increase in activity is likely as more buyers enter the market to take advantage of these improved conditions. The Fed's actions are paving the way for a cautiously optimistic outlook in the housing market.

📊 Inflation and Economic Projections

On the inflation front, projections indicate a slight uptick to 2.8% for 2024, up from a previous forecast of 2.6%. However, the Fed is optimistic that inflation will cool down to around 2% by 2027. This decline is essential for maintaining a healthy economic environment and ensuring that purchasing power remains stable.

GDP growth for 2025 and 2026 is expected to hover around 2%, aligning with long-term expectations. This steady growth, paired with a projected job rate of 4.1% for 2024, suggests that the economy is on a stable path. While the job rate reflects a slight rise from the previous 4.0%, it remains historically low, which is a positive sign for the labor market.

🏡 What This Means for Real Estate

If you’re contemplating buying, selling, or refinancing, the current climate is ripe for these moves. The key takeaway here is that lower interest rates create more favorable terms for buyers. This means more purchasing power and opportunities to secure better deals. Sellers can expect increased activity as buyers rush to capitalize on these improving conditions.

Now is the time to strategize. Whether you’re looking to enter the market or maximize your current investment, understanding these shifts can help you position yourself for success. Reach out for personalized guidance tailored to your unique situation.

🔍 The Future of the Housing Market

Looking ahead to 2025, the housing market is expected to experience several key trends. As the economy stabilizes and interest rates remain manageable, we can anticipate a boost in home sales. Here’s what to keep an eye on:

- Increased Buyer Activity: With favorable financing conditions, more buyers are likely to enter the market.

- Seller Confidence: As more buyers come into play, sellers may feel more confident listing their homes.

- Potential Inventory Growth: The combination of increased demand and seller confidence could lead to higher inventory levels.

📈 Real Estate Market Forecast for 2025

As we forecast the real estate market for 2025, several indicators will play a significant role:

- Home Sales: Expected to rise as buyer confidence increases.

- Price Stabilization: While prices may still rise, the rate of increase is likely to slow, making homes more affordable.

- Market Dynamics: The balance of supply and demand will significantly influence pricing and availability.

It’s important to remain informed about these trends, as they will guide your decisions in the coming years. The real estate market forecast is filled with potential for both buyers and sellers, provided they stay proactive and strategic.

📞 Navigating the Shifts in the Market

With the current economic climate changing, it's essential to have a strategy in place. Whether you're a first-time buyer or a seasoned investor, understanding the nuances of the market can significantly impact your success. Here are a few strategies to consider:

- Stay Informed: Keep abreast of economic indicators and market trends to make informed decisions.

- Consult with Experts: Engaging with real estate professionals can provide valuable insights and guidance.

- Be Prepared to Act: The market can shift quickly, so being ready to make decisions is crucial.

❓ Frequently Asked Questions

What are the current interest rates?

The Federal Reserve has recently set rates between 4.25% and 4.5%, which is favorable compared to previous rates.

How will the Fed's actions impact home buying?

Lower interest rates make home buying more affordable, encouraging more buyers to enter the market.

What should I do if I want to sell my home?

Now may be an excellent time to list your home, as increased buyer activity could lead to quicker sales.

How can I prepare for the 2025 housing market?

Stay informed about market trends, consult with professionals, and be ready to act when opportunities arise.

📅 Conclusion: Your Next Steps in Real Estate

The real estate market forecast for the coming years is promising, especially with the recent Fed rate cuts and an overall positive economic outlook. Whether you’re looking to buy, sell, or refinance, understanding these shifts will empower your decisions. Don’t hesitate to reach out for assistance in navigating this dynamic landscape. Together, we can develop a strategy that aligns with your goals and positions you for success in the evolving real estate market.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION