Home Selling Tips: Navigating Contingencies for a Successful Sale

Home Selling Tips: Navigating Contingencies for a Successful Sale

Are you preparing to sell your home? Understanding the process is crucial, and our Home Selling Tips will guide you through the essential contingencies involved in the transaction. From loan approvals to appraisals and inspections, we've got you covered!

🏡 Introduction to Home Selling

Selling your home can be both exciting and overwhelming. Understanding the process is essential for a successful transaction. Home Selling Tips will arm you with the knowledge you need to navigate this journey smoothly.

First, it's crucial to grasp the concept of contingencies. These are conditions that must be met for the sale to proceed. They protect both the seller and the buyer during the transaction.

🔍 Understanding Contingencies

Contingencies are a vital part of any real estate transaction. They include loan approval, appraisal, and inspection. Each plays a significant role in ensuring that the sale goes through without hitches.

- Loan Contingency: This ensures that the buyer secures financing for the home.

- Appraisal Contingency: This protects the buyer by ensuring the home appraises for the purchase price.

- Inspection Contingency: This allows the buyer to have the home inspected for any potential issues.

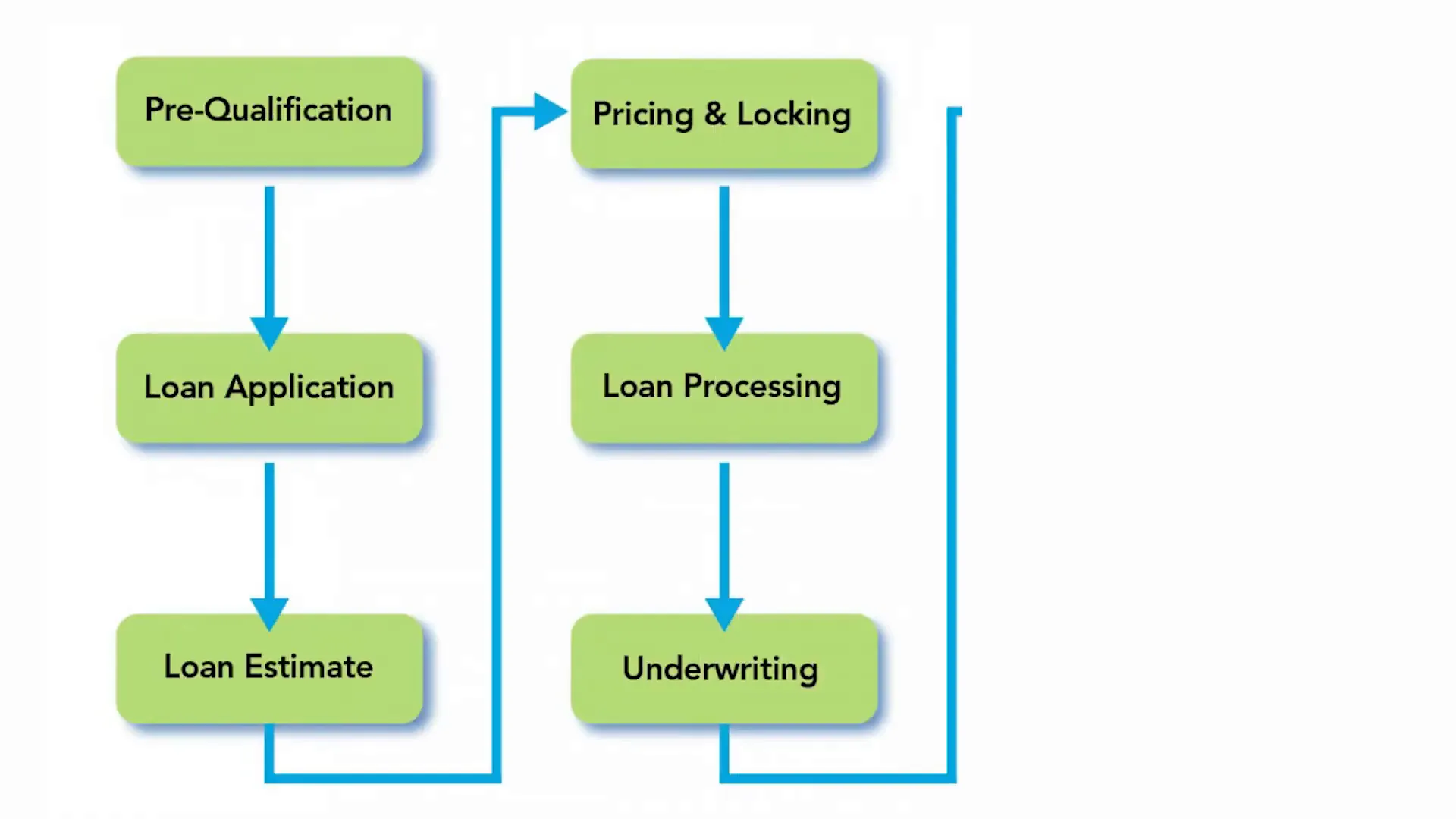

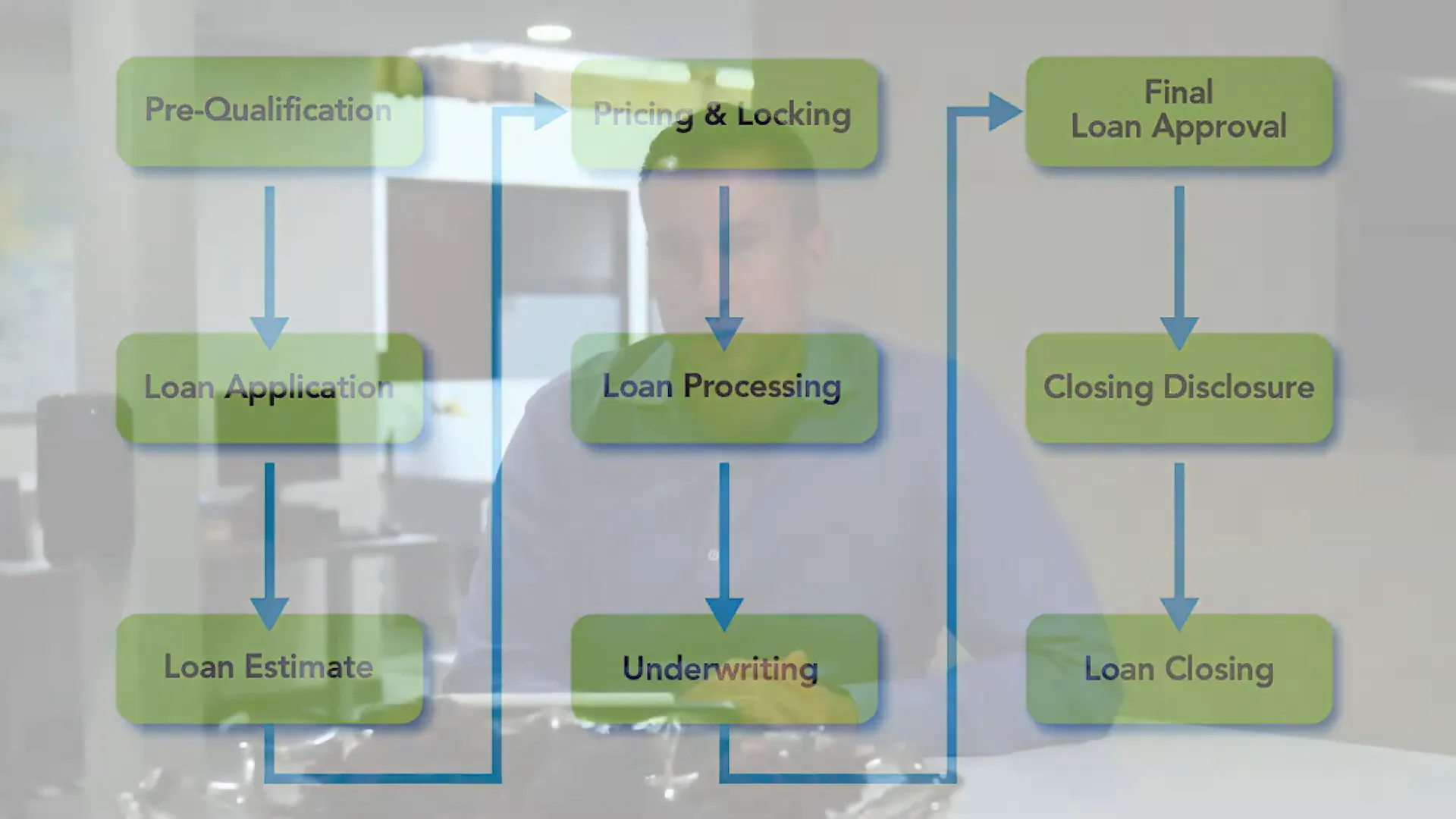

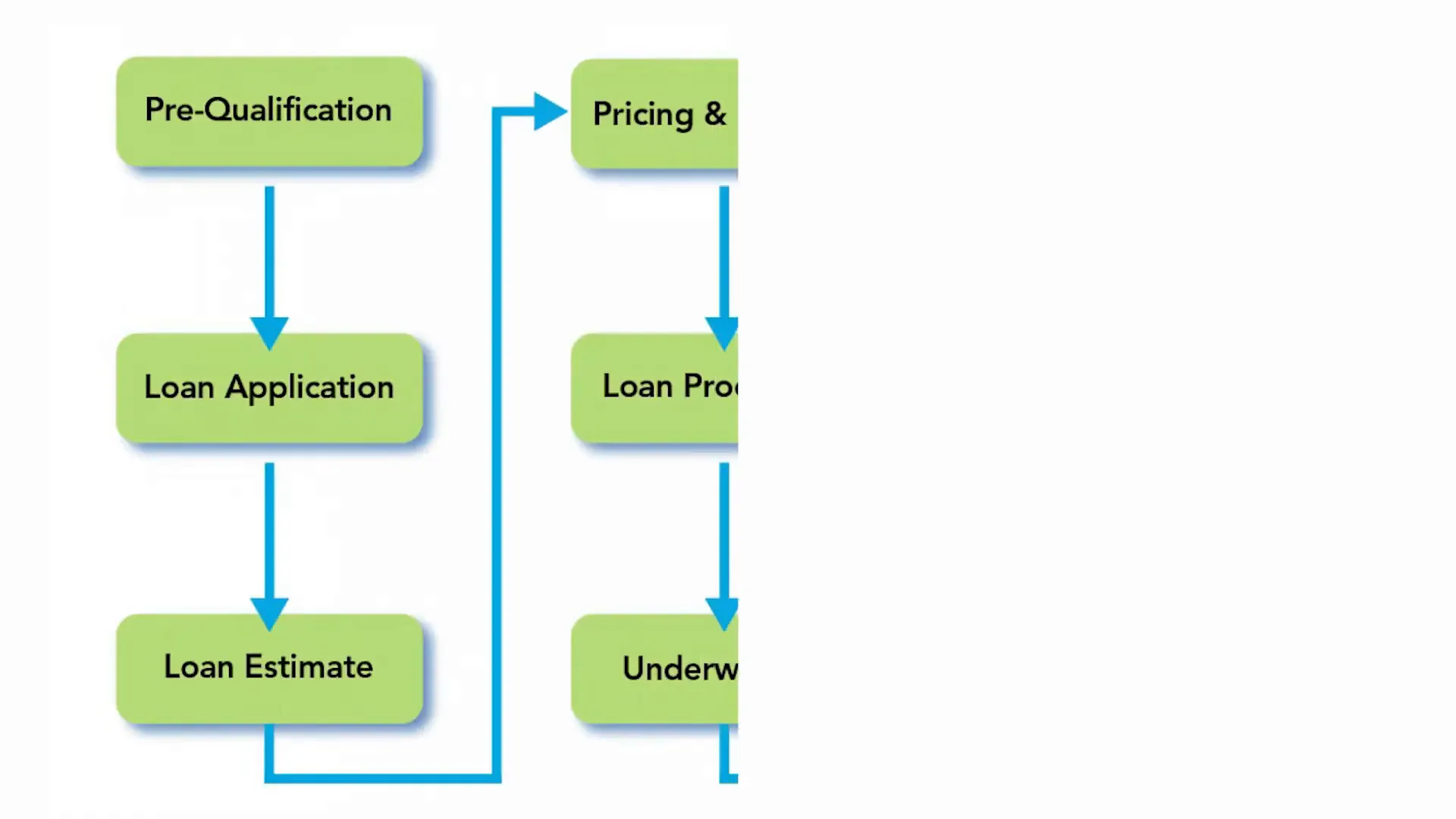

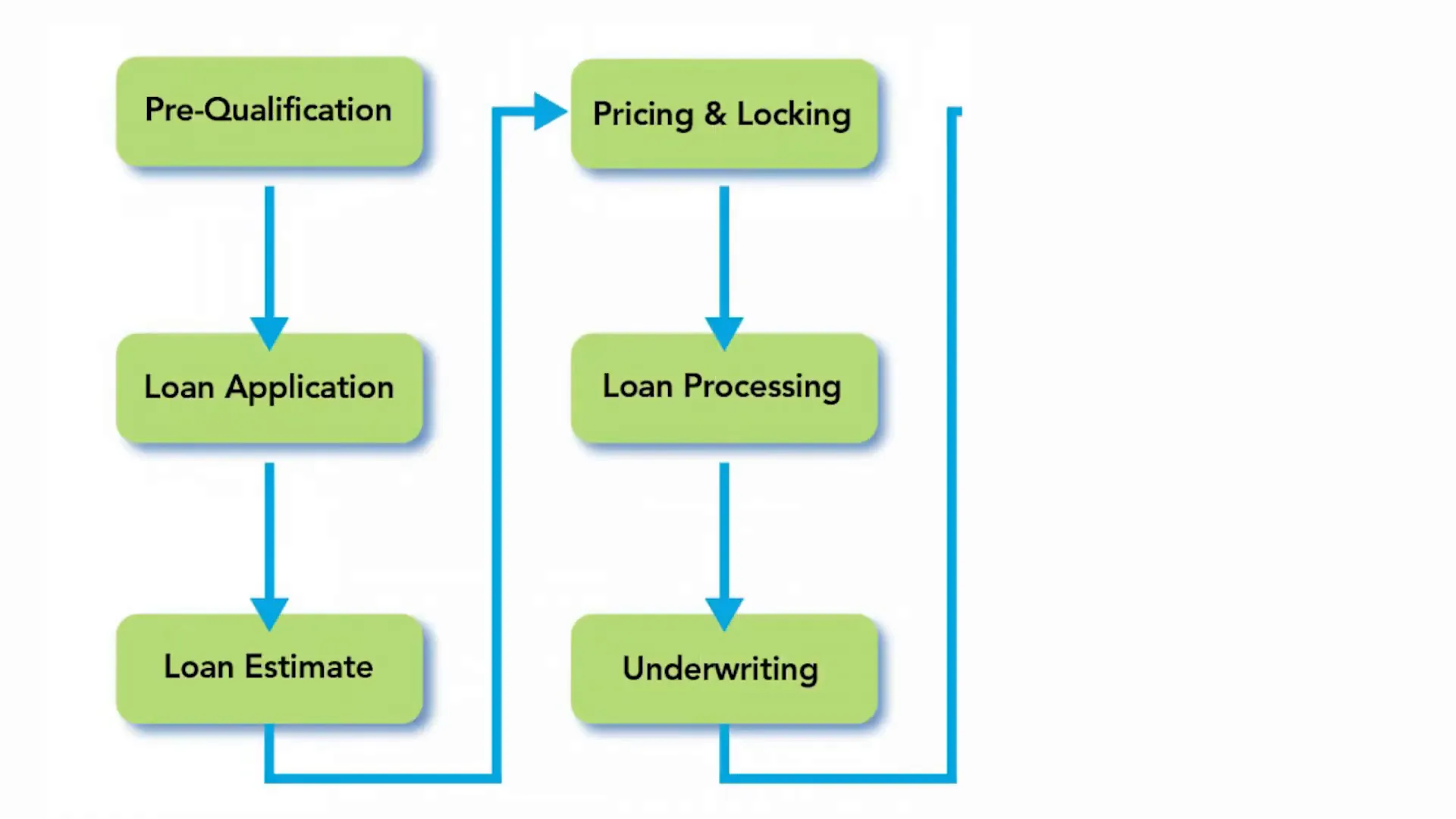

💰 The Loan Process

The loan process can be complex, but understanding it will make the journey smoother. Start by getting pre-approved for a mortgage. This step gives you a clear idea of your budget and strengthens your offer.

Once your offer is accepted, you'll need to finalize your loan application. This involves submitting various documents, including income verification and credit history. Your lender will assess your financial situation and determine your eligibility for the loan.

📏 Appraisal Concerns

Appraisals are critical in the home selling process. They determine the market value of the property. If the appraisal comes in lower than the agreed purchase price, it can lead to complications.

Many buyers worry about appraisal issues. If the value is less than expected, they may have to cover the difference out of pocket. To mitigate this risk, it's wise to discuss potential appraisal challenges with your real estate agent.

🔍 Inspection Walkthrough

Inspections are a crucial step in ensuring the home is in good condition. During the walkthrough, a professional inspector will evaluate the property for any structural or systems issues. This includes checking the roof, plumbing, electrical systems, and more.

As a seller, being proactive about potential issues can help alleviate concerns. Consider conducting a pre-inspection before listing your home. This allows you to address any problems upfront, making the selling process smoother.

⚖️ Managing Appraisal Issues

If you encounter appraisal issues, don't panic. There are several strategies to address the situation. First, consider negotiating with the buyer. You could lower the sale price to match the appraisal or offer to cover part of the difference.

Another option is to provide evidence supporting your home's value. This could include recent sales of comparable properties in your area. If necessary, you may also consider obtaining a second appraisal from a different lender.

🔄 Dual Application Strategy

When it comes to securing your loan, a dual application strategy can be a game changer. By applying through two different lenders, you not only spread out the risk but also gain a competitive edge in the appraisal process. This method ensures that if one appraisal comes in lower than expected, you have another option to rely on.

This strategy is particularly beneficial in volatile markets where property values can fluctuate. It gives you peace of mind knowing that you're not solely dependent on one appraisal, which could potentially jeopardize your purchase.

📋 Closing Table Confidence

Heading to the closing table should feel like a victory. With all contingencies managed and potential risks addressed, you can approach this final step with confidence. It’s the culmination of your hard work and careful planning.

During closing, you'll review all documents and finalize the purchase. It's an opportunity to ensure everything aligns with your expectations. Remember, this is a significant investment, and you deserve clarity on every detail.

🤝 Post-Closing Support

After closing, the relationship doesn’t end. Ongoing support is crucial for a smooth transition into your new home. Whether you have questions about home maintenance, local services, or future renovations, your agent should be available to assist you.

Consider establishing a communication plan for post-closing. Regular check-ins can help address any concerns and ensure you're settling in comfortably. This support can make all the difference as you navigate your new environment.

🌉 Exploring Bay Area Properties

The Bay Area is known for its diverse neighborhoods and unique properties. When exploring options, consider your lifestyle, commute, and local amenities. Each area offers distinct characteristics that can influence your decision.

Take the time to visit various neighborhoods. Walk around, check out local shops, and meet potential neighbors. This firsthand experience can provide insight that online research cannot.

❓ Frequently Asked Questions

As you embark on the home selling journey, several questions may arise. Here are some common queries and their answers:

- What should I do if my home doesn’t appraise at the sale price?

Consider negotiating with the buyer or providing evidence of your home's value through comparable sales.

- How can I ensure a smooth inspection process?

Conduct a pre-inspection to address any potential issues before buyers come in.

- What are the key contingencies I should be aware of?

Focus on loan, appraisal, and inspection contingencies as they are critical to the sale.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION