East Palo Alto Real Estate: Understanding the New Business Licensing Fee

East Palo Alto Real Estate: Understanding the New Business Licensing Fee

In the dynamic landscape of East Palo Alto real estate, staying updated on local regulations is crucial. Recently, the city has implemented a new business licensing fee that property owners and investors must navigate to avoid penalties. This blog will provide you with essential insights and instructions to ensure compliance and optimize your real estate investments.

📝 Introduction to East Palo Alto's Business Licensing Fee

The East Palo Alto business licensing fee is an essential aspect for any business owner in the area. This fee is not just a formality; it's a vital component of complying with local regulations. Understanding this fee can save you from unexpected penalties and ensure your business remains in good standing.

As the city evolves, so do its requirements. Recently, East Palo Alto has streamlined the business licensing process, making it crucial for property owners and business operators to stay informed.

📋 Overview of the Amnesty Program

Last year, East Palo Alto introduced an amnesty program designed to assist businesses in complying with the new licensing fee structure. This initiative allowed businesses to settle any outstanding fees without incurring penalties. However, this program had a limited window, and many missed the opportunity to take advantage of it.

During the amnesty period, businesses were encouraged to come forward, ensuring they were in compliance with local laws. This proactive approach aimed to reduce the number of businesses operating without the necessary licenses.

⏰ Implications of Missing the Deadline

Missing the deadline for the business licensing fee can lead to significant repercussions. Not only do businesses face penalties, but they also risk being flagged by the city for non-compliance. This can affect your business reputation and may lead to further legal complications.

It’s essential to mark your calendars. The deadline for submitting the licensing fee is February 1st. Late submissions can incur additional fees, compounding your financial obligations.

💰 Understanding the New Fee Structure

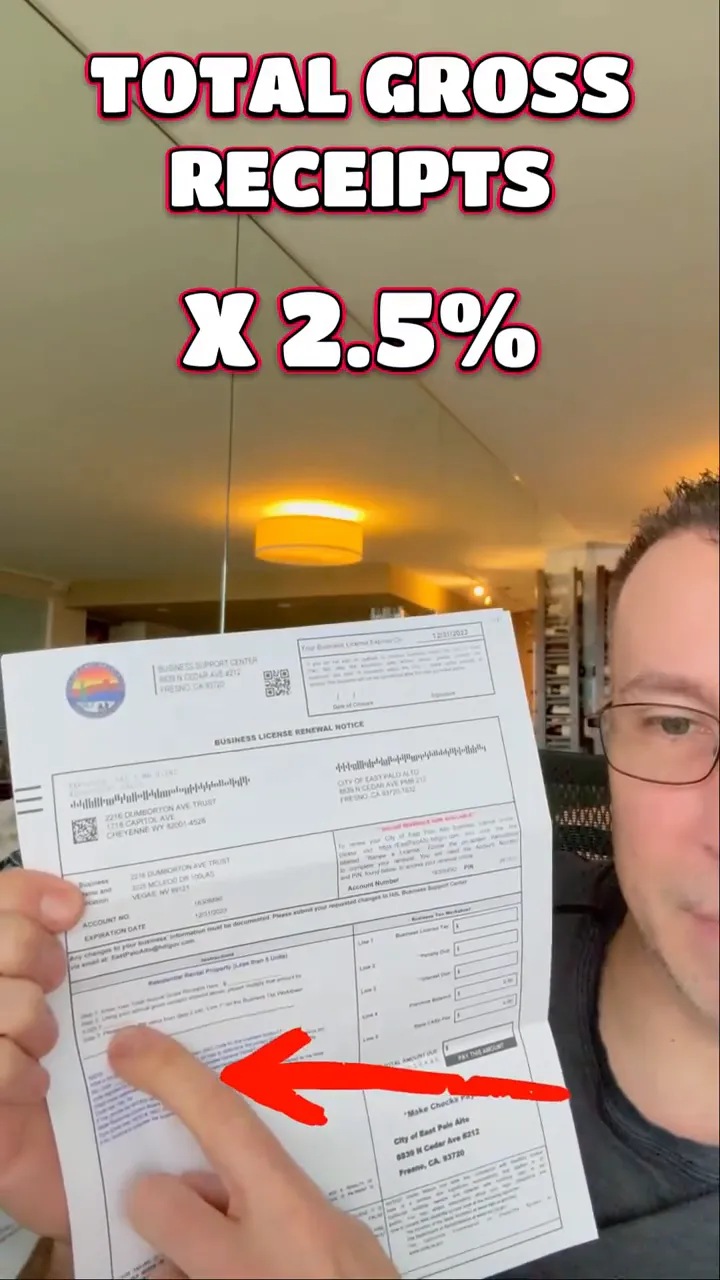

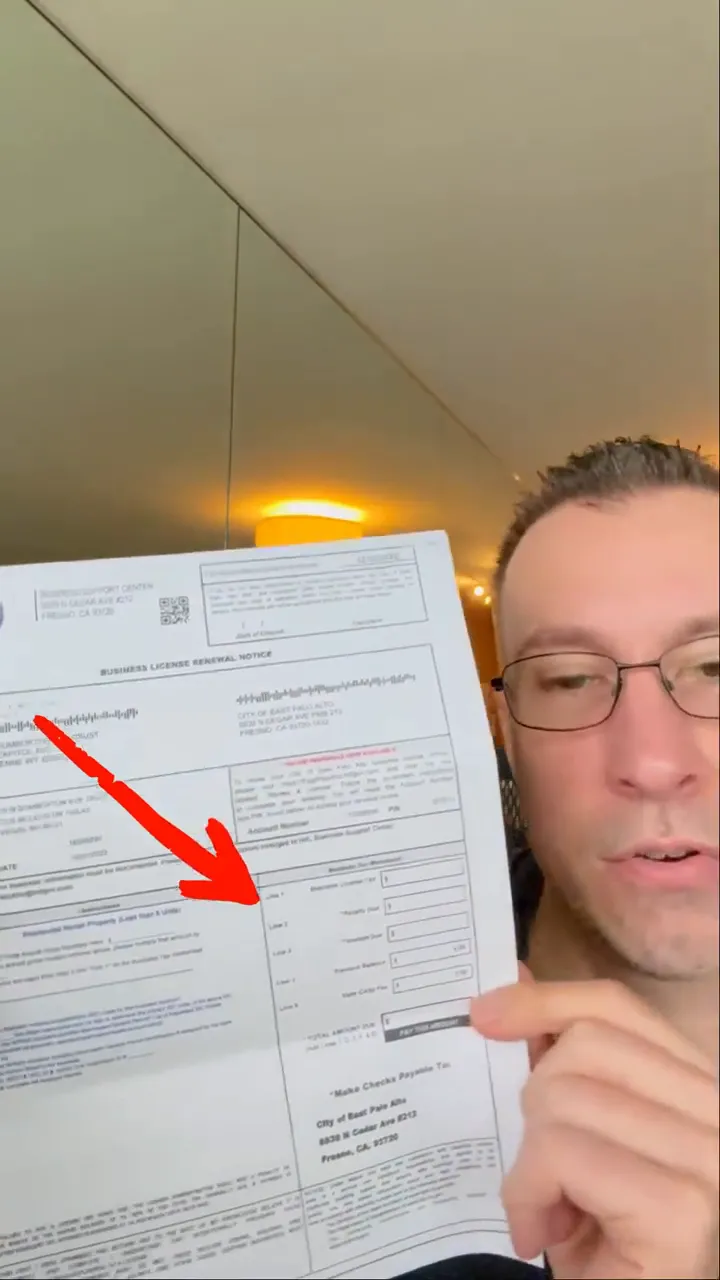

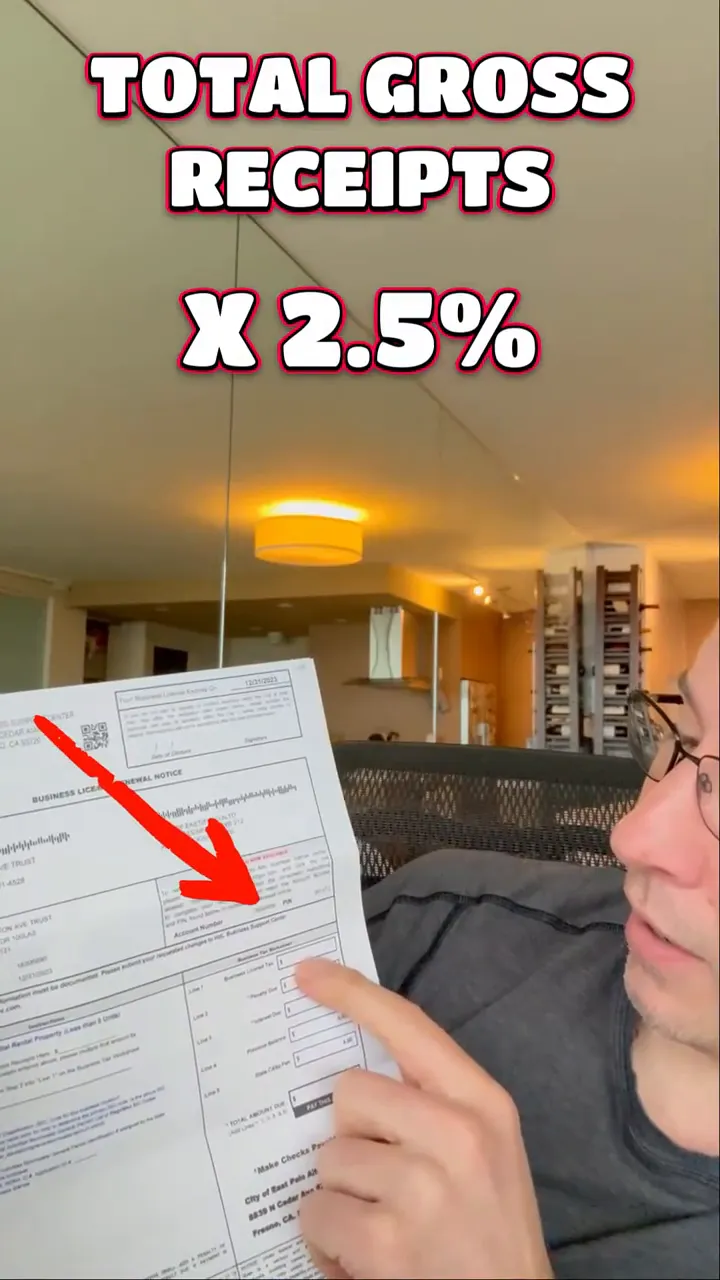

The new fee structure for East Palo Alto's business licensing is straightforward yet crucial for compliance. The city has shifted from a tiered system based on gross receipts to a flat fee of 2.5% of gross rents. This change simplifies the calculation process for business owners.

To calculate your fee, take your total gross receipts and multiply them by 2.5%. This amount is what you will owe to the city. Additionally, there is a $4 state fee that must be included in your total payment.

📞 How to Contact the Business License Department

If you have questions or need assistance with your business licensing fee, contacting the Business License Department is essential. The city outsources this department, and they can provide the necessary guidance.

The contact number for the Business License Department is 650-223-7740. Make sure to have your business information ready when you call. They can help clarify any uncertainties regarding the fee structure, payment methods, and deadlines.

🧮 Calculating Your Business Licensing Fee

Calculating your business licensing fee in East Palo Alto is a straightforward process. Start by determining your total gross receipts for the year. Once you have that number, multiply it by 2.5% to find the amount owed.

For example, if your gross receipts are $100,000, your licensing fee would be $2,500. Don't forget to add the $4 state fee to your total. It's essential to ensure that your calculations are accurate to avoid any discrepancies.

Once you have your total amount, you can either write a check or complete the payment online. Be sure to keep a record of your payment for your records.

💳 Payment Options for the Licensing Fee

When it comes to paying the business licensing fee in East Palo Alto, you have several convenient options. Understanding these methods can simplify your compliance process and ensure timely payments.

- Online Payment: The city offers an online portal for easy payment processing. This method is quick and allows you to complete your transaction from the comfort of your home or office.

- Check Payment: If you prefer traditional methods, you can write a check. Be sure to include all necessary details, such as your business name and the total amount due.

- In-Person Payment: If you have questions or need assistance, consider visiting the Business License Department in person. This can provide you with immediate support and clarification on any issues.

📅 Important Deadlines to Remember

Staying aware of key deadlines is essential for compliance with the East Palo Alto business licensing fee. Missing these dates can lead to penalties and complications for your business.

- Licensing Fee Deadline: The primary deadline for submitting the business licensing fee is February 1st. Ensure your payment is postmarked by this date to avoid late fees.

- Amnesty Program Dates: Although the amnesty program has concluded, it's important to note when it was active. Many missed the opportunity to settle previous balances without penalties.

- Payment Processing Time: If paying online, allow adequate time for processing. It’s advisable to complete your payment well ahead of the deadline.

🆘 Getting Further Assistance

If you find yourself needing more information or assistance regarding the business licensing fee, don't hesitate to reach out. There are several resources available to help you navigate the process.

- Business License Department: Contact the Business License Department directly at 650-223-7740. They can provide answers to your specific questions and guide you through the licensing process.

- Online Resources: Visit the East Palo Alto city website for detailed guidelines and FAQs about the licensing fee. This can be a valuable source of information.

- Real Estate Professionals: Consulting with local real estate experts can also provide insights and assistance tailored to your specific situation in the East Palo Alto real estate market.

🔍 Conclusion: Navigating East Palo Alto Real Estate

Navigating the East Palo Alto real estate landscape requires a keen understanding of local regulations, including the new business licensing fee. By staying informed and adhering to deadlines, you can protect your investments and ensure compliance.

Remember, the shift to a flat fee structure simplifies the calculation process, making it easier for business owners to manage their finances. Utilize the resources available to you, and don’t hesitate to reach out for help when needed.

❓ FAQ about East Palo Alto Real Estate

As you navigate the complexities of East Palo Alto real estate, you may have several questions. Here are some frequently asked questions to guide you:

- What is the business licensing fee based on? The fee is a flat 2.5% of your gross rents, simplifying the previous tiered structure.

- What happens if I miss the payment deadline? Late payments may incur penalties and can affect your business's compliance status.

- Can I apply for assistance with the licensing fee? Yes, the Business License Department is available to assist you with any questions or concerns.

- Is the amnesty program still available? No, the amnesty program has concluded, so it’s crucial to ensure compliance moving forward.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION