East Menlo Park Market Update: Housing Trends & Insights for January 2025

In this East Menlo Park Market Update, we explore the latest housing trends and insights that are shaping the real estate landscape. Whether you're a homeowner or potential buyer, understanding these changes can help you navigate the market effectively.

🏡 Introduction to the East Menlo Park Market

The East Menlo Park housing market is a unique blend of opportunity and challenge. With its proximity to Silicon Valley, the area attracts a diverse mix of buyers, from tech professionals to families seeking a suburban lifestyle. Understanding the current state of the market is crucial for anyone looking to buy or sell property in this vibrant community.

Market dynamics here are influenced by various factors, including economic conditions, interest rates, and local demand. As we delve into the current trends, it's important to recognize how these elements interact to shape the East Menlo Park Market Update.

Current Pricing Trends

Pricing trends in East Menlo Park have shown relative stability over the past year. While fluctuations occur, the overall price movement remains flat. This stability can be attributed to high interest rates, which have tempered buyer enthusiasm.

In recent months, homes have sold for prices that hover around previous averages. However, some properties have commanded significantly higher prices, skewing the overall data. It's essential to analyze these trends to determine the best strategies for buying or selling.

Understanding Fluctuations in Prices

Fluctuations in home prices can be puzzling, especially in a market like East Menlo Park. One contributing factor is the limited number of sales, which can lead to significant swings in data representation. For instance, a few high-value sales can drastically alter the perceived market value.

This volatility means that potential buyers and sellers should be cautious. A single sale above average can create an illusion of rising prices, while the broader market remains stable. Understanding this phenomenon is key to making informed decisions.

Sales Data Gaps Explained

Another aspect of the East Menlo Park Market Update is the occasional gaps in sales data. These gaps often arise from the limited number of transactions in the area. When sales volume is low, the data may not accurately reflect market conditions.

It's crucial to take these gaps into account when interpreting market trends. A few transactions can disproportionately affect averages, leading to misleading conclusions. Therefore, a comprehensive analysis is essential for a clearer picture of the market.

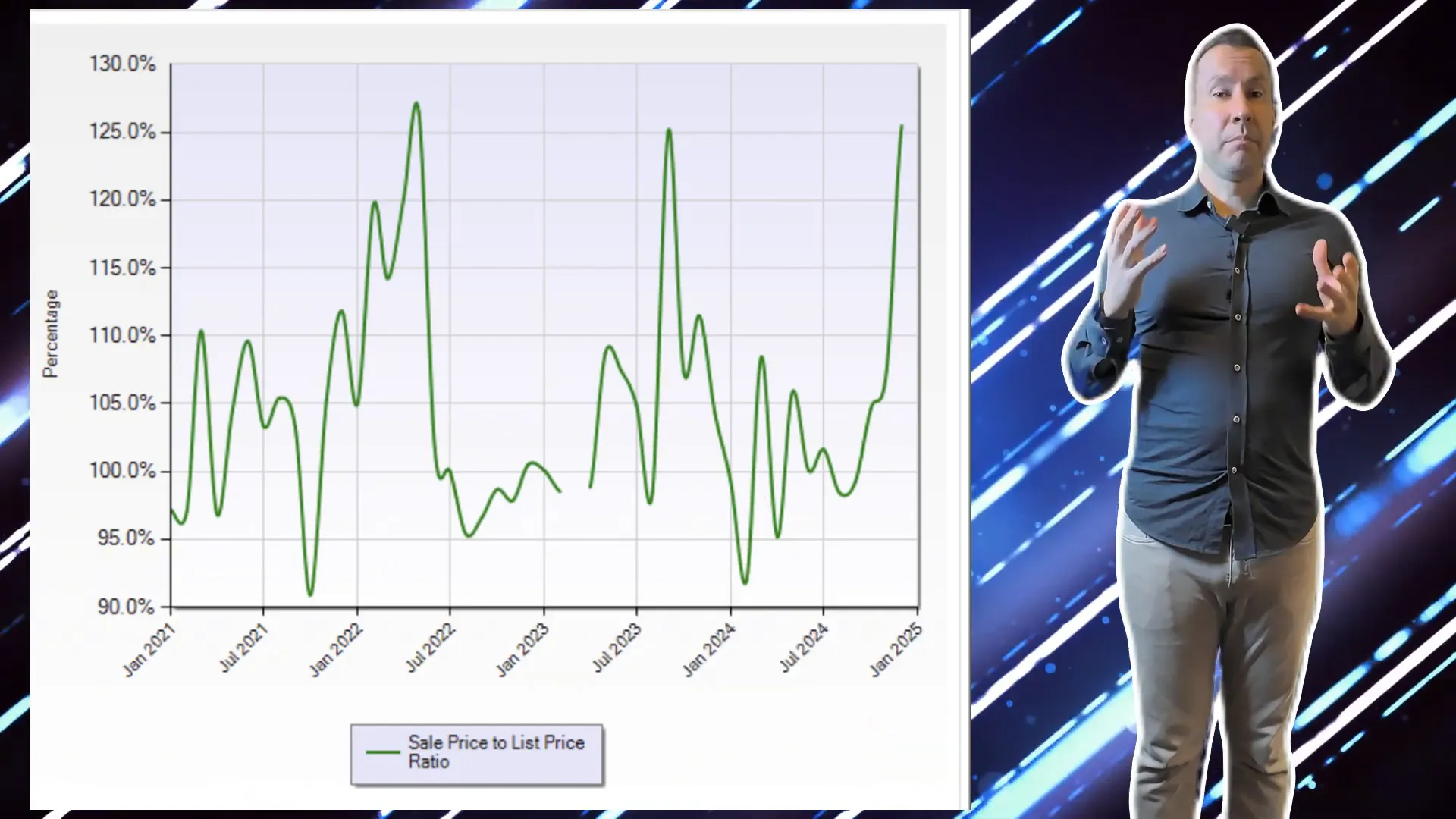

List to Sales Price Ratio Analysis

The list to sales price ratio serves as an important metric in evaluating the East Menlo Park Market. This ratio provides insights into how properties are performing relative to their listing prices. Currently, there is a noticeable upswing in this ratio, indicating that homes are selling for well above their asking prices.

Such a trend suggests heightened buyer competition and a strong demand for properties. Sellers may find themselves in a favorable position, as homes are moving quickly and at premium prices. This analysis is vital for anyone considering entering the market.

Current Market Dynamics

The current market dynamics in East Menlo Park are shaped by several factors, including interest rates and local demand. Interest rates have remained high but are projected to decrease in the near future. This potential decline could further stimulate the market, attracting more buyers.

Properties are currently selling in less than 20 days, a sign of a competitive environment. Buyers are advised to act swiftly, especially on well-priced homes. The landscape is evolving, and understanding these dynamics will help navigate the market effectively.

📅 Days on Market Insights

The days on market (DOM) metric provides crucial insights into the East Menlo Park housing landscape. Currently, homes are selling in less than 20 days, indicating a competitive environment. This rapid turnover signals strong buyer interest and demand.

When properties are well-priced, they tend to attract multiple offers quickly. This trend is significant for sellers, as it suggests that the right pricing strategy can lead to swift sales, often above asking price. Understanding DOM helps both buyers and sellers gauge the urgency and competitiveness of the market.

Factors Influencing Days on Market

- Pricing Strategy: Homes priced accurately tend to sell faster.

- Market Demand: High demand leads to quicker sales.

- Property Condition: Well-maintained homes attract more buyers.

These factors collectively contribute to the current DOM statistics. Sellers should focus on presenting their properties in the best light to maximize interest and minimize days on the market.

📈 Interest Rate Trends

Interest rates have been a significant factor in shaping the East Menlo Park real estate market. Although rates have remained relatively high, there are indications that they may decrease in the near future. Predictions suggest a potential drop by the end of the first quarter or the beginning of the second quarter.

This shift could have a considerable impact on buyer behavior. Lower interest rates typically stimulate demand, making it easier for buyers to afford homes. As rates decline, we may see an influx of buyers entering the market, further driving competition.

Implications of Interest Rate Changes

- Increased Buyer Activity: Lower rates often encourage more buyers to enter the market.

- Potential for Higher Prices: Increased demand can lead to higher home prices.

- Refinancing Opportunities: Homeowners may seek to refinance their mortgages at lower rates.

Understanding these trends is vital for anyone looking to buy or sell in East Menlo Park. Monitoring interest rates can provide insights into market timing and strategy adjustments.

💸 Impact of Inflation on the Market

Inflation plays a crucial role in the real estate market, influencing both interest rates and purchasing power. Rising inflation can lead to higher borrowing costs, which can deter potential buyers. Conversely, if inflation stabilizes, it may allow for a more favorable interest rate environment.

Currently, inflation rates are a key factor to watch. The trajectory of inflation will significantly impact the overall economic landscape, including employment rates and consumer spending. A stable inflation rate can foster a more predictable housing market.

Strategies for Navigating Inflation

- Monitor Economic Indicators: Stay informed about inflation rates and economic forecasts.

- Adjust Pricing Strategies: Sellers may need to consider inflation's impact on pricing.

- Evaluate Financing Options: Buyers should explore various financing options to mitigate costs.

By understanding inflation's effects, buyers and sellers can make informed decisions that align with current market conditions. This awareness can lead to better timing and strategic planning.

🔍 Conclusion and Next Steps

The East Menlo Park Market Update reveals a dynamic real estate environment characterized by rapid sales and fluctuating interest rates. As we move further into 2025, staying informed about market trends will be essential for both buyers and sellers.

For sellers, now may be an opportune time to list properties, especially if they are well-priced. Buyers, on the other hand, should remain vigilant for potential interest rate changes that could affect their purchasing power. Engaging with a knowledgeable local real estate expert can provide invaluable insights tailored to your specific situation.

❓ FAQ

What is the average days on market in East Menlo Park?

Currently, homes are selling in less than 20 days, indicating a fast-paced market.

How do interest rates affect home buying?

Higher interest rates can deter buyers by increasing borrowing costs, while lower rates can stimulate demand.

What should sellers consider when pricing their homes?

Sellers should analyze current market trends, comparable sales, and the condition of their property to set a competitive price.

How can inflation impact the housing market?

Inflation can influence interest rates and purchasing power, affecting both buyer demand and home prices.

Staying informed and proactive in this evolving landscape will be key to navigating the East Menlo Park Market successfully.

Categories

- All Blogs (314)

- Client Testimonials (19)

- East Palo Alto (81)

- Graeham Watts Home Tours (23)

- Home Buyer's Process (34)

- Home Tours (28)

- Houses for sale in East Palo Alto (13)

- Investing (18)

- Landlord and Tenant Info (9)

- Menlo Park (49)

- Personal (5)

- Real Estate Questions Answered (91)

- Real Estate Tips (86)

- Redwood City (85)

- San Mateo County (10)

- Seller's Process (22)

Recent Posts

GET MORE INFORMATION